How to Pitch to Investors: Solid Strategies to Acquire Startup Funding

Pitching to investors is a fine art.

Tech pioneer and venture capitalist Marc Andreessen says his VC company listens to around 4,000 startup pitches a year. And guess what? He rejects funding around half of them.

How do you convince investors to reach into their pockets and fund your vision?

Read on to learn how you can increase your chances of acquiring funding for your startup.

In this article, I’ll share pitching strategies and tips that have helped us grow startups from zero to multimillion dollars. This article will touch on:

Let’s get started!

3-point strategy to prepare to pitch to investors

These three points are mainly about having the right mindset and possessing adequate knowledge to make sure your pitch is as perfect and effective as possible.

Point 1: Cultivate a learner’s mindset

Though being positive has its benefits, it’s best to keep an open mind and consider the possibility of not getting funded.

And what’s the best way to prepare for this possibility?

By cultivating a learner’s mindset.

In the book The Lean Startup by Eric Ries, he mentions the value of validated learning, which is knowing through customer feedback if a new product could lead to sustained revenues or is simply something nobody wants. He implies that this learning is as valuable as gold since it helps the company develop a product that will eventually lead to long-term financial success.

Source: AZ QUOTES

How do you apply Ries’ philosophy when pitching to investors?

If one or two investors reject your pitch and refuse to give you funding, don’t lose heart.

Take every pitch as a learning opportunity. What questions did the investors ask? What aspects of your presentation or proposed business did they dislike? Be sure to have a notebook or recorder handy so you can keep all the golden insights you need to improve your pitch or business idea.

Ultimately, a rejected investor pitch is only a failure if you didn’t learn anything from it.

Point 2: Research about your investors

It’s a mistake to assume all investors care about the same things. Before your pitch, do your homework on each investor. Look into their past investments, what influences their decisions, and the questions they typically ask. While you might not find all this information online, reaching out to other founders who’ve worked with them can arm you with valuable insights.

In the world of investment, venture capitalists (VCs) and angel investors are the main players. Each has their own preferences and priorities.

VCs typically have a higher risk tolerance and seek investments with the potential for significant returns. They may also have more stringent criteria and due diligence processes for evaluating investment opportunities, particularly during the seed funding round. Highlighting the potential of your project to generate significant financial returns is the key to the heart of this investor segment.

Angel investors, on the other hand, are individual investors with significant personal wealth. They tend to have varying levels of risk tolerance, but they often invest in startups based on personal interests, industry experience, or a belief in the founder’s vision. When pitching to them, emphasize the broader vision of your project and the size of the market it seeks to serve.

Point 3: Survey the economic and investment landscape

Before presenting your pitch deck to investors, study the landscape where your business operates or will operate.

For example, during economic headwinds like recessions, you should emphasize in your elevator pitch (the “introduction” of your pitch) that your business has the fiscal discipline and solid business model to weather the difficulties. It also helps to back it with a strategy proving you can market your offering at reasonable prices without affecting the bottom line.

This communicates that while you are passionate about your product, service, or idea, you are also grounded in reality and capable of making pragmatic decisions.

💡Pro Tip: Adapting to economic trends is essential for the success of any business, regardless of its stage of development. Whether you’re just starting out or already established, staying responsive to changes ensures resilience and growth.

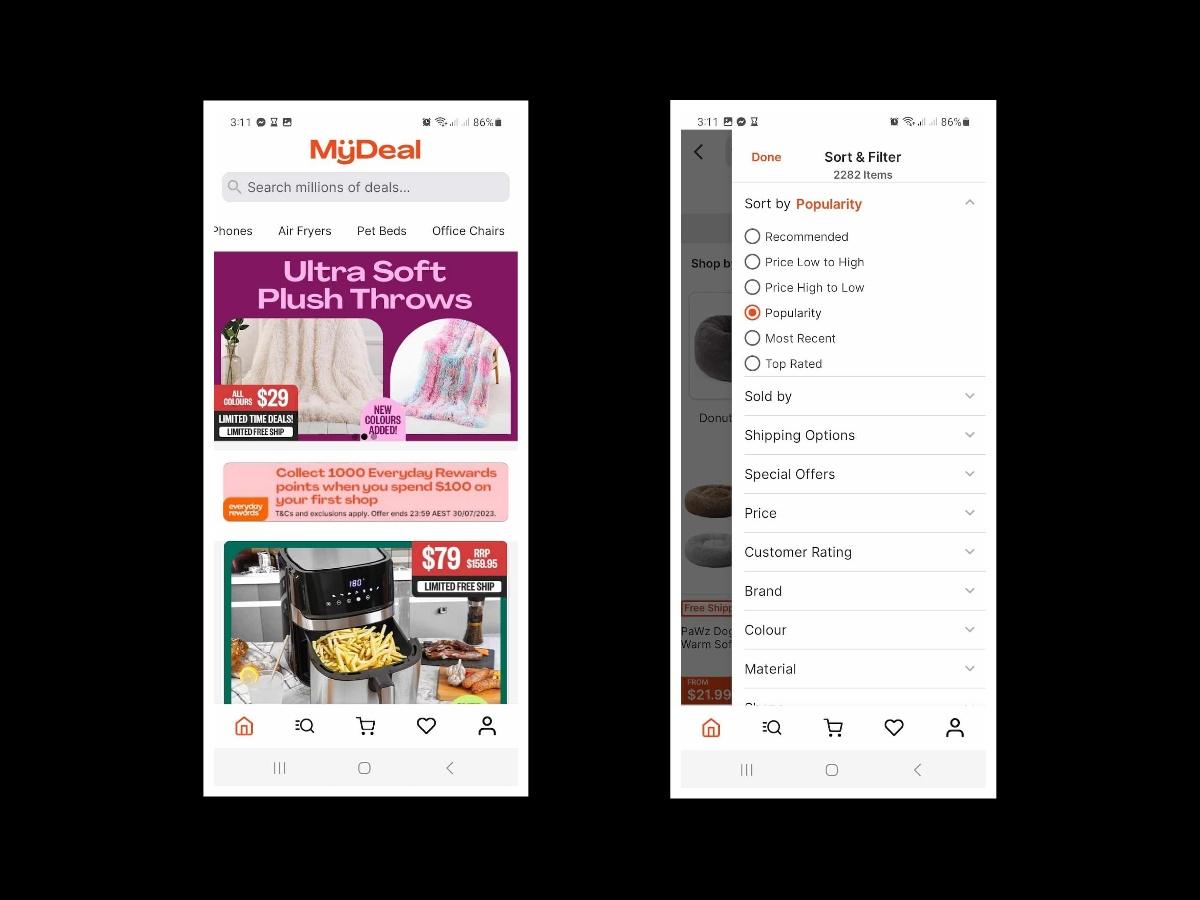

Take the case of MyDeal, for example. The ecommerce company already had a website to help customers buy merchandise online. But the rise in smartphone usage prompted the company to invest in mobile app development to make shopping more convenient for more people. Check out the MyDeal case study to discover how the company succeeded in attracting more customers and sales through its mobile app.

Source: MyDeal mobile app

Now that you know how to prepare for a pitch to investors, let’s discuss what you should present.

10-point action plan for an effective pitch to investors

Point 1: Present your elevator pitch

Investors usually listen to more than one pitch in one sitting. So they often seek a concise roadmap of a venture, which is approximately within 30 seconds. Crafting an elevator pitch is essential as it condenses all the relevant information you’re about to present.

Ensure that your short, polished, yet passionate elevator pitch covers the following elements:

- An overview of your business, including its structure, founders, and key details

- Your product or service, highlighting anything pertinent to your company’s offerings

- Your value proposition, emphasizing the advantages your product or service brings

Above all, readiness is vital — you must be prepared to deliver your pitch in any scenario. Opportunities to explain your idea to potential investors can arise unexpectedly, so always stay prepared.

Point 2: Share your story

Communicate in a passionate yet factual manner the desire and dreams that inspired you to start pursuing your startup idea. If done right, the investors will be rooting for you and want to see you succeed.

Everything you say at this stage will require data to back up your claims. An overview of audience segmentation, financial projections, and other information will help you sell your company story.

When planning the story slides of your deck, make sure you include the following:

- The consumer problem or market gap you see

- How your company and the investor’s funding will solve this problem

- Your audience or customer base, who your business will help, and how

- Why your business needs funding at this point more than any other

A compelling story is such a powerful force that it can turn an idea into a creative invention. Entrepreneur Andre Eikmeier wanted to convince people to save the planet by encouraging them to take baby steps toward mitigating global warming and other large-scale problems. He was eventually able to launch the innovative social app Good Empire to make his vision a reality.

Point 3: Present your market analysis

Backing your product with solid research transforms it from merely an idea into a strategic plan. This segment of your pitch is a key convincing element for potential investors since it indicates that your plan is primed for execution.

Get the latest industry news first.

Ensure your market analysis presentation encompasses the following key points for a compelling pitch deck:

- Target audience. Define your audience or ideal customers, highlighting their values, desires, and needs.

- Competition. Illustrate the level of competition in your market. Investors are wary of oversaturation, yet too little competition might signal lack of demand. Either way, you must communicate the profitability potential of your idea.

- Industry landscape. Provide an overview of market history leading up to your pitch, along with your projections for the sector’s future.

- Market growth potential. Highlight relevant facts and figures that reflect potential for growth within your target market.

- Risk mitigation strategies. Address potential risks in the market, whether legal, regulatory, environmental, or other obstacles. Then, outline how you plan to navigate them.

Ultimately, you want to make sure investors are convinced that your product or service has a solid market waiting, willing, and able to pay for your offering. Research shows that a major reason startups fail is an absence of market need.

Be careful not to show any lack of confidence in presenting and explaining your market analysis when pitching. Investors may think your business doesn’t have a robust market need awaiting it, potentially turning them off.

Source: CB Insights

Point 4: Introduce and showcase your product or service

Once you’ve provided a broad overview of your product or service, it’s time to delve into the specifics. A crucial step here is to offer a demonstration where investors can interact with or experience your offering firsthand.

Preparing and testing a demo for a digital service or physical product is paramount. For instance, if you’re presenting an app, ensuring that its core features can be flawlessly showcased during the pitch is essential.

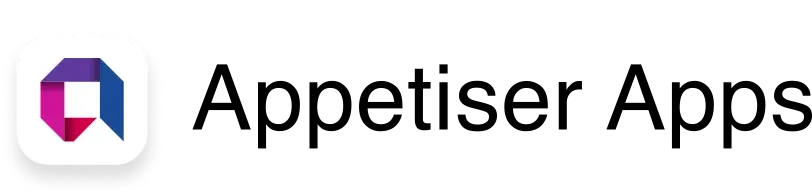

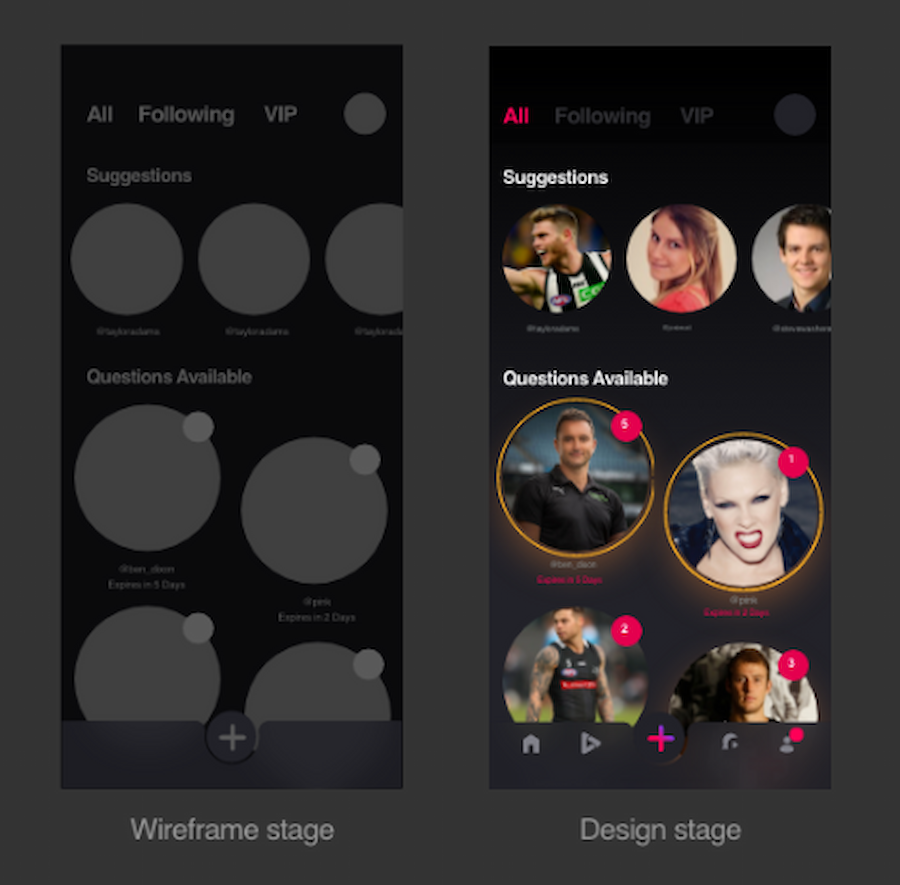

One of the most effective ways to demo an app is through a prototype.

A prototype is like a first draft of an app, showing how its final version will work and look. An app prototype enables investors to see the relationship between different buttons and menus and lets them feel like they’re using the actual app.

Take note that a prototype only has the appearance and feel of an app — it does not offer actual products or services. But quality prototypes have given many startups a competitive advantage when seeking funding.

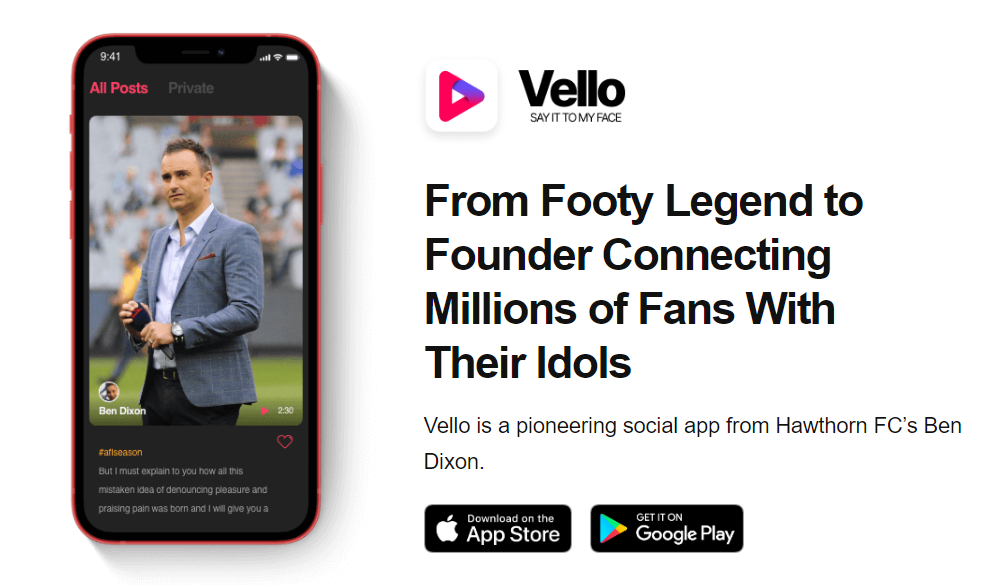

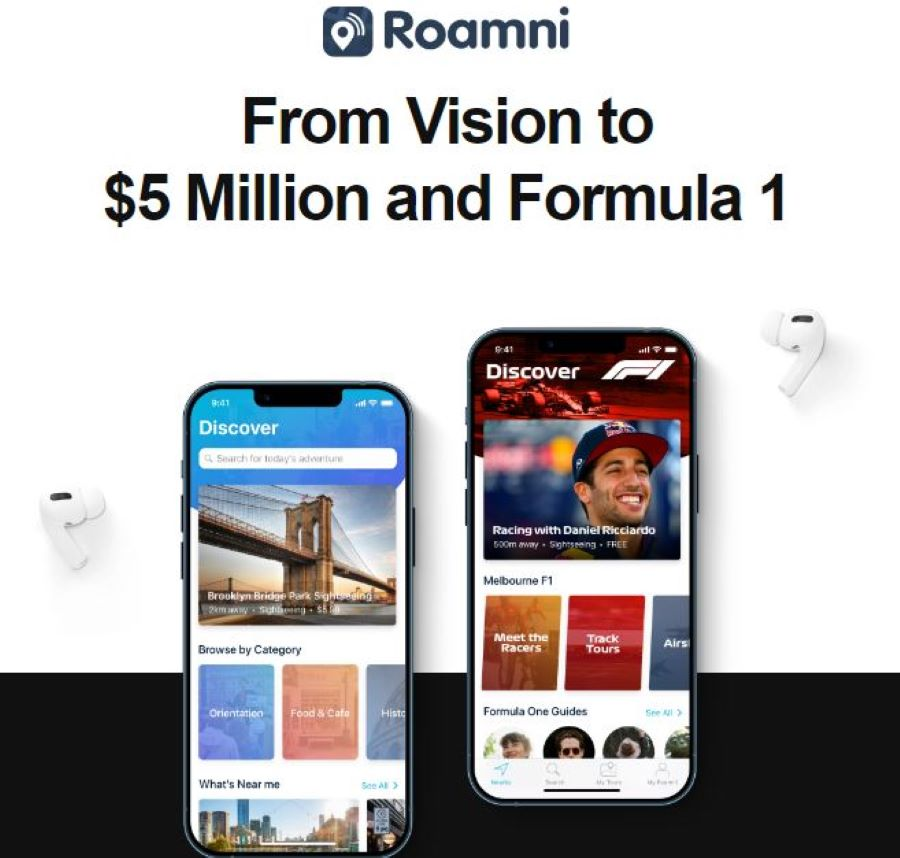

At Appetiser Apps, we have designed many successful prototypes for our clients. The most notable ones, such as Vello and Roamni, were able to use their prototypes to win funding worth around $600,000 and $1,000,000, respectively.

To increase your chances of succeeding like Vello and Roamni, test your demo product or prototype before the pitch. Ironing out any potential issues is crucial. Investors expect a seamless real-time experience, so meticulous checking and rechecking are necessary until the moment of presentation.

Point 5: Discuss the income and business model

Once your pitch has captivated investors, the spotlight shifts to a pivotal factor—the business model. This is one of the most crucial sections of your pitch. Investors pay meticulous attention to this section because it is a major factor in convincing them whether or not your business is worth risking funding for.

Since potential investors see this part as important, prepare very well for this section since they will keenly observe any irregularities and pose numerous questions.

To demonstrate how your business intends to generate profits, incorporate the following into your pitch:

- Pricing structure for each product or service

- Fee arrangement, whether it’s a per-item charge or a subscription on a monthly or yearly basis

- Different tiers of services or products along with their corresponding pricing, such as a premium plan tailored for businesses

- How the pricing strategy aligns with your revenue targets, explaining the number of products or services to be sold to reach a specific revenue goal

- Projections concerning return on investment, including the anticipated amounts and timelines

Point 6: Outline your customer acquisition strategy clearly

Investors are drawn to business ideas that have the potential to scale continuously.

Emphasize your plan for acquiring new customers and highlight key performance indicators in your presentation. Ensure to cover the following aspects to demonstrate how you intend to attract businesses:

- Growth metrics. Provide insights into essential metrics including customer acquisition cost (CAC), customer retention rate (CRR), and conversion rate to showcase your growth potential.

- Sales process overview. Outline the journey from lead generation to closing a sale, providing clarity on how your company navigates through each stage.

- Marketing channels. Detail your strategy for utilizing various marketing methods, such as direct sales, traditional advertising, and digital marketing channels like social media, blog pages, etc.

In our experience, one of the most effective methods to acquire customers is through website development. When we wrote blogs for sports betting company PointsBet, we were able to penetrate the U.S. market and helped increase the company’s value from $65 million to around $2 billion.

Do you want to make the same thing happen for your business? Have a chat with us!

Point 7: Showcase the talent and integrity of your team

Apart from your idea, market analysis, and financial projections, investors are keen on knowing who they’re entrusting their money to.

Highlighting your team’s strengths and integrity is crucial to instilling confidence in the investor.

Many studies have shown that ethical companies tend to be the best-performing ones financially. Investors tend to bet their money on people with integrity because they know the funds will be put to good use.

Here are some key considerations for optimizing your team pitch:

- Outline the future plans, aspirations, and growth trajectory of your team as integral parts of your pitch.

- Highlight the skills, experience, and qualifications of your team members.

- Discuss any integrity initiatives your business is pursuing or plans to pursue, such as ESG endeavors, CSR initiatives, etc.

- Acknowledge any current shortcomings and outline strategies for addressing them.

Point 8: Clarify your financial projections

Outline your revenue targets for the upcoming 3 to 5 years. Detail the expected revenue for each product and provide a clear explanation of when and how your business anticipates achieving these figures.

Adjust the level of detail of your financial projections based on your investor audience. If the investors who will see your pitch are venture capitalists or banks, you can delve deeper into the figures. But if you’re presenting to angel investors and other people with little to no financial training, avoid using too many numbers and strive to keep your projections straightforward and easy to understand.

Point 9: Explain your need for funding

Articulate to investors the reasons behind your funding requirements so they can provide the level of financing that best suits your needs.

Ensure you address the following aspects to rationalize your funding request and facilitate the closing of the deal:

- Ownership breakdown. Outline the prospective ownership stakes for investors and the current equity distribution.

- Present funding status. Detail the amount of funding you’ve acquired thus far and its sources.

- Allocation of funds. Specify where the invested capital will be utilized and what its intended purposes are.

- Funding gap. Clearly state the additional investment required to meet your objectives.

- Post-investment business status. Describe the business’s standing once the allocated funds are exhausted.

This part of the pitch also serves as a good opportunity to reaffirm your commitment to prudently and transparently manage the investor’s funds, fostering a sense of confidence among all stakeholders.

Point 10: Present your exit plan

As you advance through fundraising stages beyond the seed phase, it becomes crucial to outline your exit strategy for potential investors. This strategy could mean being acquired by a larger company, a management buyout, or taking the company public.

Regardless of the specific plan, it’s important to let investors know why this exit strategy aligns with the company’s goals and what it signifies for their investment. While investors may not be fixated on the mechanics of the exit, they are keen to understand how they will realize returns on their investment, whether it’s in 5 or 10 years down the line.

Pitch it perfect

Ultimately, having a growth mindset, doing your homework, and presenting the right amount and type of information can make your pitch as close to perfect as possible.

Though there’s no 100% guarantee you will get your pitch to investors right the first time, persistence and using this article as your guide increases your chances of getting the funding you need for your business.

Have an app idea and need help pitching it? Book a free consultation with us and learn other avenues for funding and business success.

Jesus Carmelo Arguelles, aka Mel, is a Content Marketing Specialist by profession. Though he holds a bachelor’s degree in business administration, he also took courses in fields like computer troubleshooting and data analytics. He also has a wealth of experience in content writing, marketing, education, and customer support. Outside office hours, he finds deep joy in reading, traveling, and photography.

Get the latest industry news first.