7 Best Investment Apps in 2024

Thanks to the rise of investment apps, investing has become more accessible than ever.

Whether you’re a seasoned investor or just starting on your financial journey, many investment apps offer a convenient way to manage your investments, understand market trends, and make informed decisions.

In this blog, we’ll explore the seven best investment apps of 2024, namely:

- Robinhood: Best investment app for beginners

- Wealthfront: Best investing app for hands-off investors

- Acorns: Best for investors looking to start small

- Fidelity Investments: Best for simplifying financial management

- Webull: Best investment app for active traders

- Betterment: Best for those looking for personalized advice

- thinkorswim: Best for experienced investors

Our list is created by a team of app developers, strategists, and specialists with experience in growing successful apps. We evaluate apps based on their innovation, features, performance, ease of use, and overall user satisfaction.

Please take note that the information provided in this article is for educational and informational purposes only. The inclusion of any investment apps in this guide does not mean that our team at Appetiser endorses or recommends them.

Investing involves risk, and it’s important to conduct thorough research and consult with a reputable financial advisor before making any investment decisions. Please carefully review the terms and conditions, fees, and features of any investment app before using them.

Now that that’s out of the way, let’s discuss the investing apps that made it to the list.

The 7 Best Investing Apps

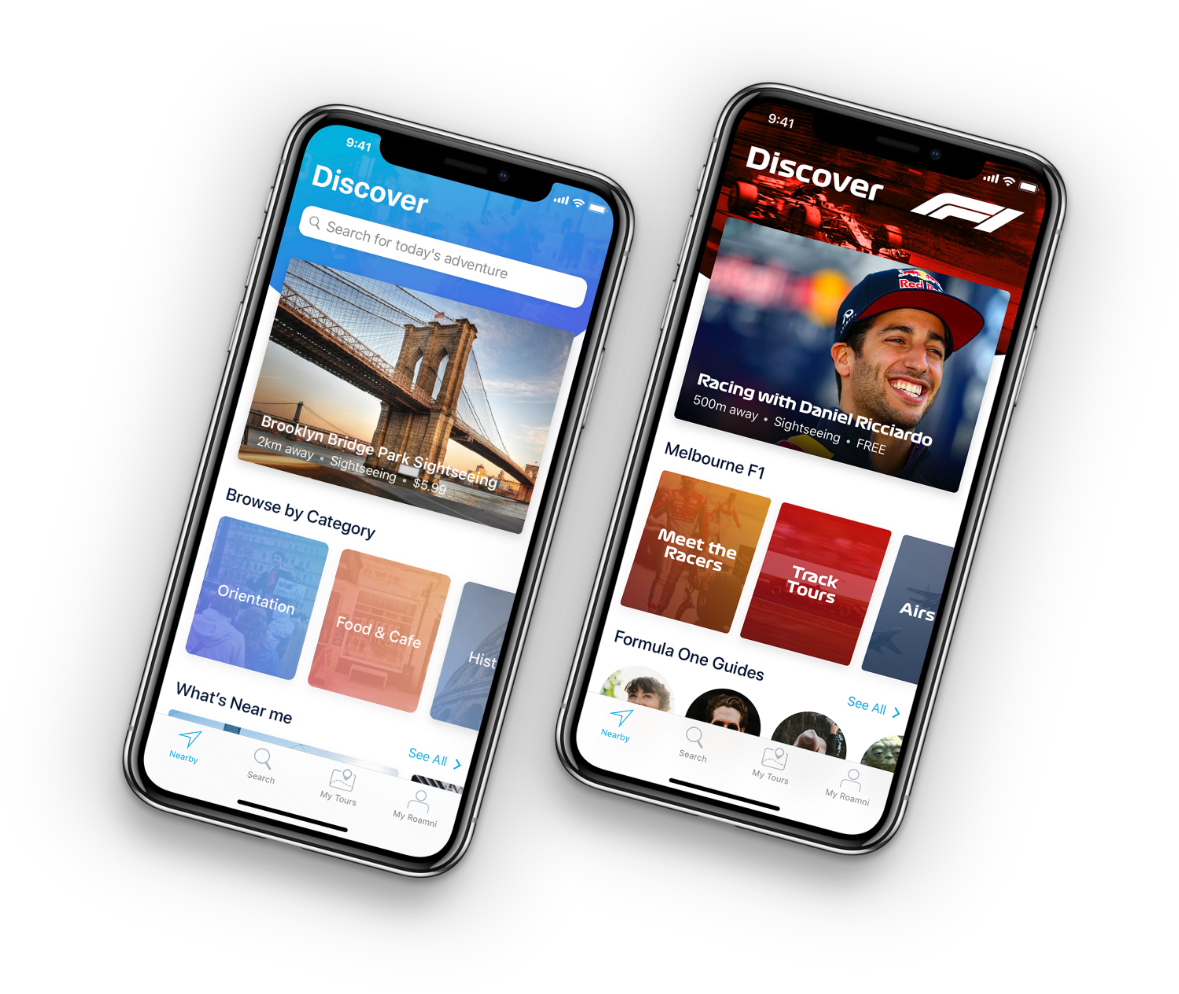

1. Robinhood: Best investment app for beginners

Source: Robinhood

Robinhood was founded in 2013 by Vladimir Tenev and Baiju Bhatt, two Stanford University graduates with a vision of making investing accessible to everyone. It has 4.2 and 4.1 ratings on the App Store and Play Store respectively and has been downloaded 10+ million times.

Among the reasons we see behind Robinhood’s popularity is its accessibility. It lets you trade in the stock market without charging any fees, and you can start investing with just $1.

More advanced options are available through subscription services, such as Robinhood Gold. This offers extra benefits like being able to trade outside regular hours, borrowing money to invest, and making bigger instant deposits. The app also has a cash management feature called the Robinhood Cash Card. With this card, you can earn 2% cash back on certain purchases.

Additionally, Robinhood provides educational resources, including articles, tutorials, and investment insights, to help beginners learn about investing concepts, market trends, and financial planning.

Device Compatibility:

Pricing:

- Free trading on stocks, options, ETFs, and cryptocurrencies

- Robinhood Gold: $5/month after 30-day free trial

Pros:

- Commission-free trading on a wide range of assets

- Access to advanced features through Robinhood Gold subscription

- User-friendly interface and intuitive mobile app

Cons:

- Limited customer support options

- Some users may find the platform’s simplicity lacking in advanced features

- Recent controversies surrounding trade restrictions on certain securities

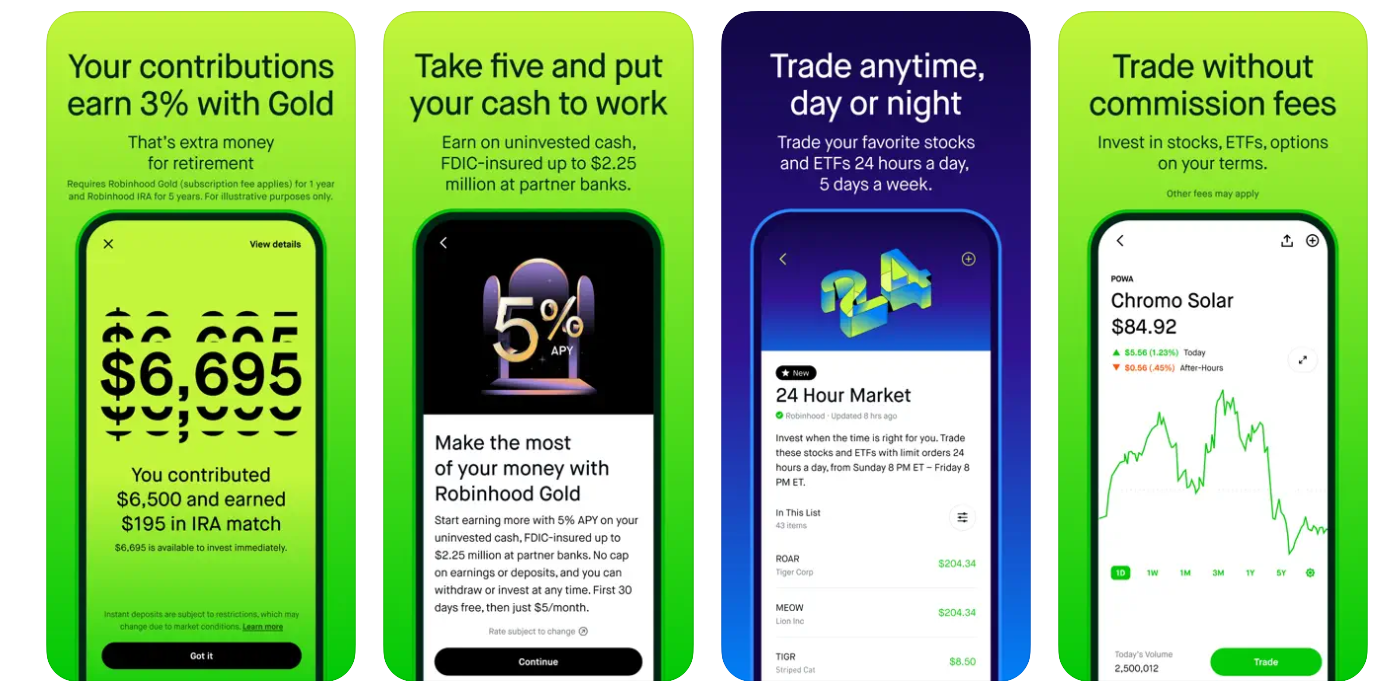

2. Wealthfront: Best investing app for hands-off investors

Source: Wealthfront

Wealthfront offers a straightforward and automated solution so you can invest in your goals with minimal effort. The app uses smart algorithms to build and handle diverse investment portfolios tailored to your financial goals and risk tolerance.

Say your goal is to plan for retirement. The platform will assess how much risk you’re comfortable with, how long you have until retirement, and your financial situation. Then, it creates a personalized plan to help you reach your goals. This simplified approach makes investment accessible to individuals with varying levels of investment knowledge.

Wealthfront also offers the ability to earn a high annual percentage yield (APY) on your cash with its Cash Account. A high APY on cash savings means that you earn more money on the cash you keep in your savings account. It’s like getting a higher reward for keeping your money in that account instead of spending it immediately.

The app has achieved 4.8 ratings on both the App Store and Google Play.

Pros:

- High APY on cash savings

- Diversified investment portfolio

- Zero-commission stock trading

Cons:

- Limited availability of certain features in some regions

- Occasional delays in customer support response times reported by some users

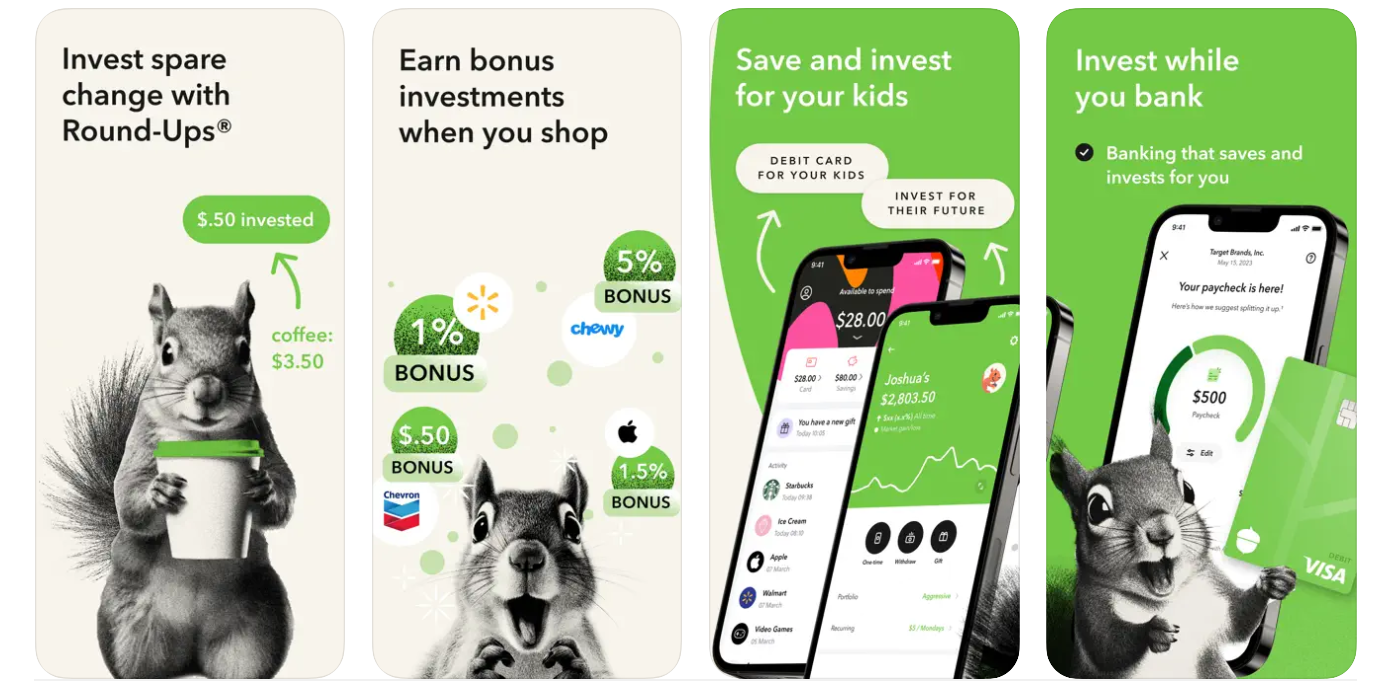

3. Acorns: Best for investors looking to start small

Source: Acorns

Acorns takes a unique approach to investing with its feature called the Round-Ups®. It works by automatically rounding up your everyday purchases to the nearest dollar and investing the spare change into a diversified portfolio. This “set it and forget it” strategy makes investing effortless and is ideal for those with lower risk tolerance.

The app also offers Acorns Early, where parents can set up investment accounts for their children and start saving for their education or other long-term goals.

Besides offering investment tools, Acorns also gives you access to educational materials aimed at improving your understanding of finances and guiding you towards smarter financial choices. These resources are available in different forms like articles, videos, and personalized recommendations.

Acorns has garnered a rating of 4.7 on both the App Store and Google Play.

Device Compatibility:

- Android

- iOS

Pricing:

- Acorns Personal: $3/month

- Acorns Personal Plus: $5/month

- Acorns Premium: $9/month

Pros:

- Simplified investing and saving

- Diversified ETF portfolios

- Exclusive perks and rewards

Cons:

- Monthly subscription fees

- Limited customization options for investment portfolios

- Available only for US residents

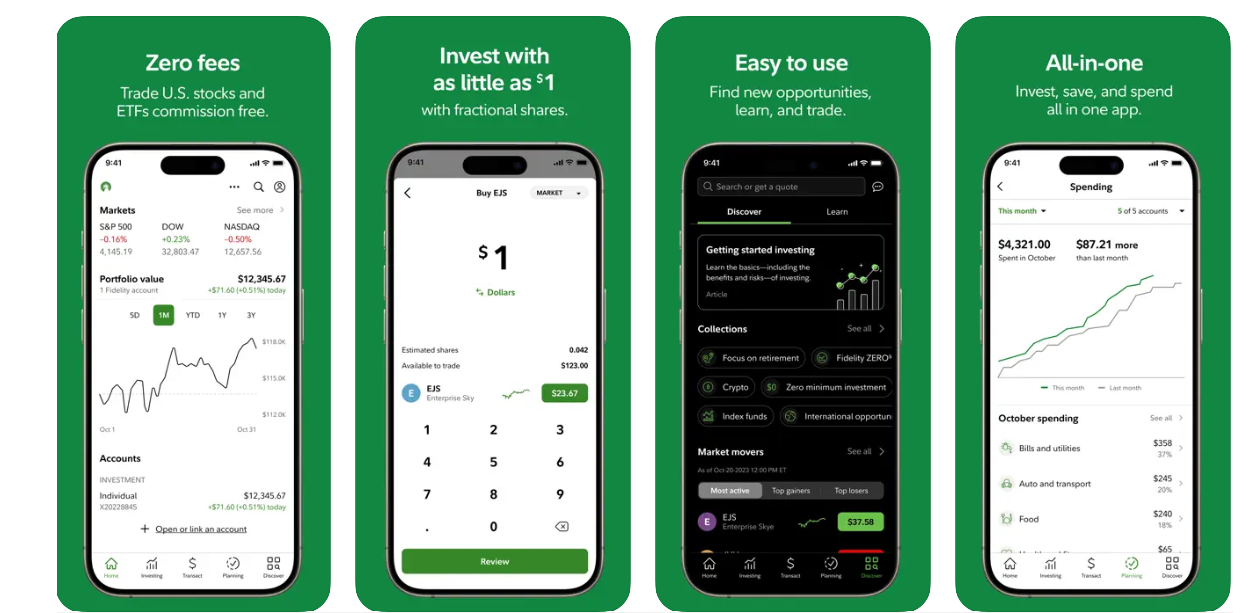

4. Fidelity Investments: Best for simplifying financial management

Source: Fidelity Investments

The Fidelity app provides a centralized dashboard where you can view all of your investment accounts in one place. It aims to serve as an all-in-one financial hub with cash management features and access to financial education resources such as podcasts, articles, and videos.

You can deposit checks, pay bills, track spending and portfolio performance, and trade stocks seamlessly. Additionally, you can also access market news, analyst research reports, financial data, and customizable charting tools to conduct thorough analysis and research before making investment decisions.

When opening a retail brokerage account, Fidelity allows you to start investing without account fees or minimums. The application also allows you to trade US stocks, ETFs, and fractional shares without charging any commission. Investments can start from as little as $1.

Fidelity has a 4.8 rating on the App Store and 4.4 on the Play Store.

Device Compatibility:

- Android

- iOS

Pricing:

- Free account opening with no account fees or minimums

- Commission-free trades for US stocks, ETFs, and fractional shares

- Investments possible for as little as $1

Pros:

- Secure measures such as 2-factor authentication and voice biometrics

- No account fees or minimums for retail brokerage accounts

- All-in-one app for trading stocks, depositing checks, paying bills, and more

Cons:

- Potentially overwhelming interface for some users

- Varying customer service response times

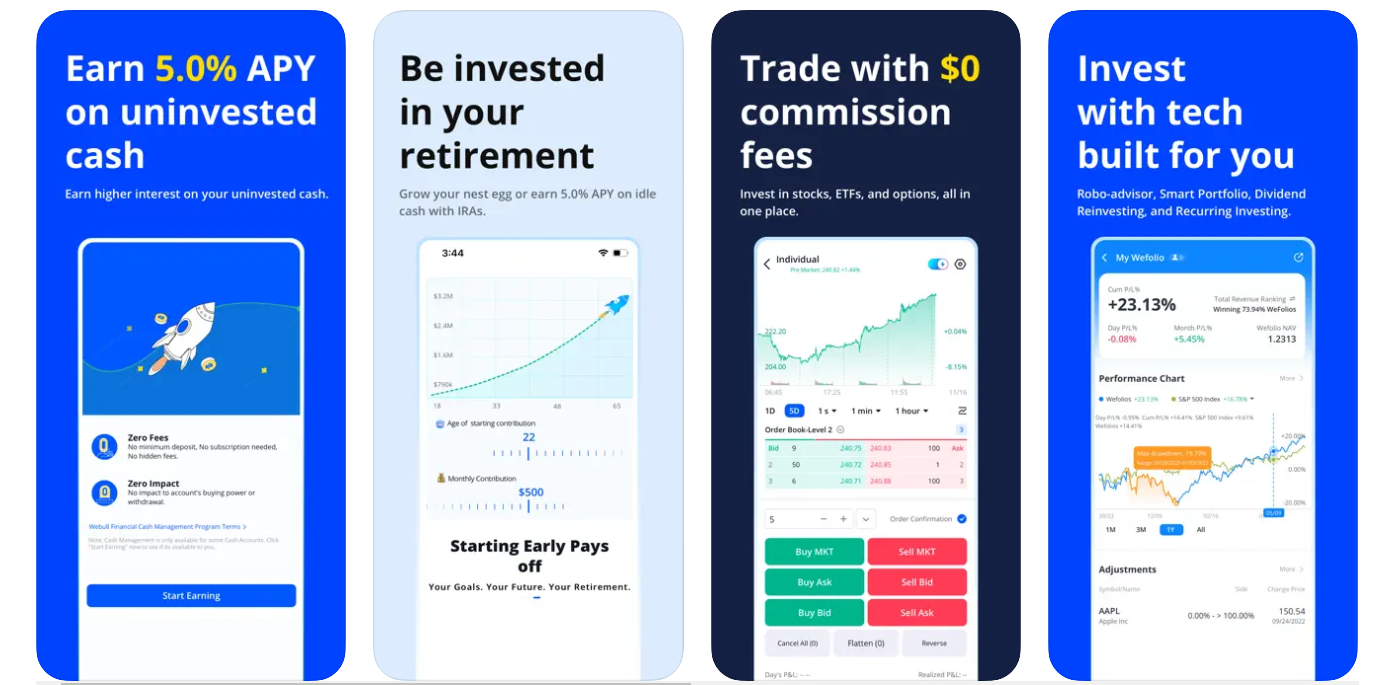

5. Webull: Best investment app for active traders

Source: Webull

Active trading requires access to up-to-the-minute market data to make quick and informed trading decisions. If you are more keen on taking control of your investments, Webull offers real-time quotes, news, and alerts so you can capitalize on market opportunities as they arise.

The app also provides advanced charting tools so you can conduct in-depth technical analysis, identify trends, and execute precise entry and exit points for your trades.

Like most apps we’ve listed, Webull offers a commission-free trading model. This allows you to buy and sell stocks, ETFs, and options without incurring any fees. Additionally, the platform offers fractional shares, enabling you to start with as little as $5 and diversify your portfolios with ease.

While Webull is ideal for seasoned traders, it also has a range of features suitable for beginners. These include an automated investing option as well as simulated trading, where you can practice without risking real money.

Webull has 4.7 and 4.3 ratings on the App Store and Google Play respectively.

Device Compatibility:

- Android

- iOS

Pricing:

- Free trading on stocks, ETFs, and options

- Competitive APY on uninvested cash

- No account minimums or fees

Pros:

- Commission-free trading on stocks, ETFs, and options

- Competitive APY on uninvested cash

- Range of advanced tools and features for both beginners and seasoned investors

Cons:

- Limited availability of certain features in the Cash Management Program

- Some users may find the platform overwhelming due to the abundance of features

- Availability of foreign stocks limited to OTC markets in real-time

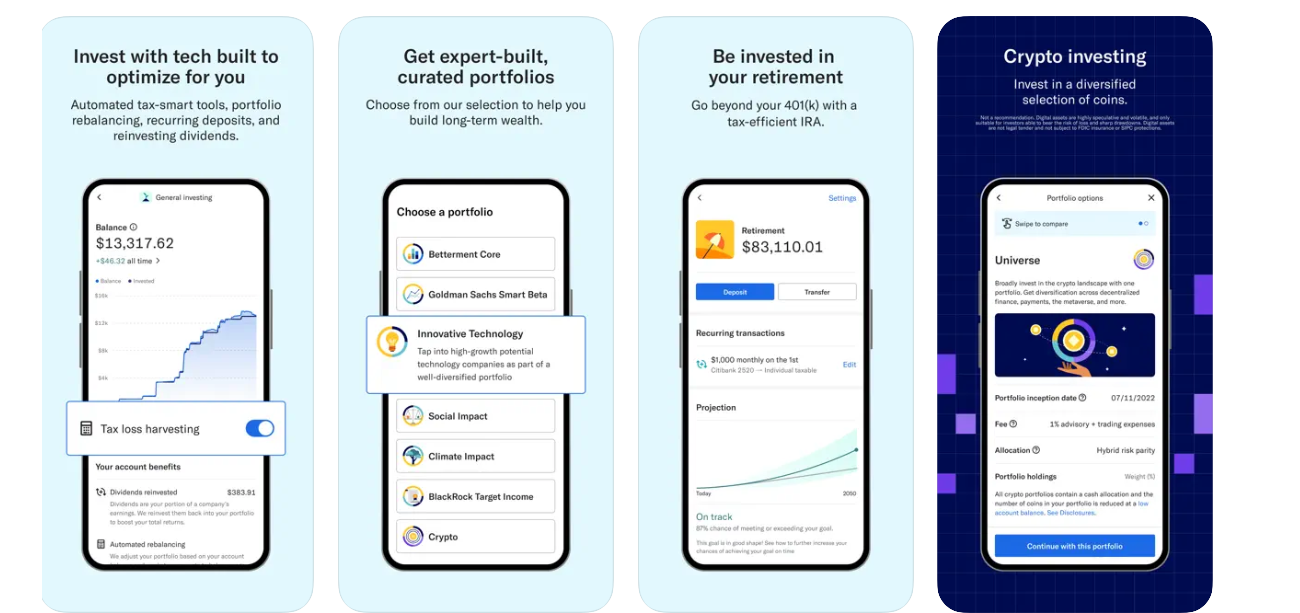

6. Betterment: Best for those looking for personalized advice

Source: Betterment

Betterment is another popular robo-advisor that takes a hands-off approach to investing. The app uses advanced algorithms to automatically rebalance your portfolios and optimize asset allocation based on market conditions. This helps ensure that your investments remain aligned with your goals.

With features like goal-based investing and tax-efficient strategies, Betterment allows you to set specific financial goals, such as saving for retirement, funding your child’s education, or buying a home.

The app then creates a customized investment portfolio tailored to your goal, time horizon, and risk tolerance. You can choose from a variety of ETFs, including options for innovative tech, socially responsible investing, and more.

Betterment has a rating of 4.7 in the App Store and 4.6 in Google Play.

Device Compatibility:

- Android

- iOS

Pricing:

- Free to download and use

- Basic: $4/month or an annual fee of 0.25% on invested assets

- Premium: Additional features for a fee of 0.4% on invested assets

Pros:

- Personalized investment portfolios tailored to individual goals

- Tax-efficient investing strategies

- Access to Certified Financial Planner™ professionals at a fraction of the cost

Cons:

- Premium features come with additional fees

- Reliance on automated algorithms may not suit investors seeking full control over their portfolios

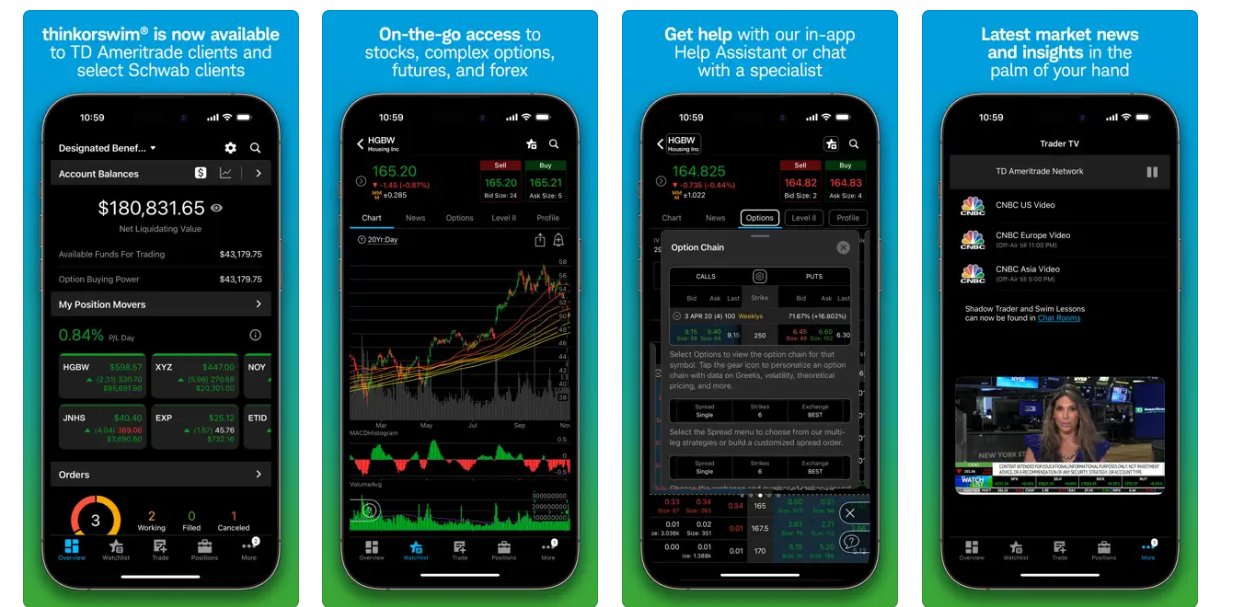

7. thinkorswim: Best for experienced investors

Source: thinkorswim

thinkorswim is a trading app that provides access to a diverse range of investment products, including stocks, options, ETFs, mutual funds, futures, and cryptocurrencies. It was developed by TD Ameritrade, a subsidiary of multinational financial services company The Charles Schwab Corporation.

One of the highlights of thinkorswim is its comprehensive charting tools. Traders have access to customizable charts with a wide range of technical indicators, allowing for visual and in-depth analysis of market trends and patterns. With its advanced trading tools, thinkorswim is ideal for active traders and experienced investors who want to enhance their portfolios.

Another key feature of thinkorswim is its paper trading functionality, which allows you to practice trading strategies in a simulated environment using real market data. This tool enables you to hone your skills and test out new strategies without risking any capital.

thinkorswim has garnered a 4.7 rating on the App Store and 3.1 on Google Play.

Pros:

- Comprehensive trading platform with advanced features

- Real-time support from trading specialists

- Live streaming programming from leading financial networks

Cons:

- Options trading involves risks and may not be suitable for all investors

- Market volatility, volume, and system availability may impact account access and trade executions

- May require a learning curve for new users unfamiliar with advanced trading tools

Frequently Asked Questions About Investment Apps

1. Are investing apps safe to use?

Investing apps generally are safe to use. But as with any matters involving finances, we highly recommend that you conduct due diligence before making any investment decisions. Just as you would carefully evaluate and ask key questions before hiring a wealth manager, you must research the people behind an app before using one.

Choose a reputable platform with robust security measures in place. Among these measures are encryption to protect your personal and financial information and two-factor authentication for added security.

2. Do investment apps provide advisory or brokerage services?

Yes, most investment apps offer a range of advisory and brokerage services to cater to different investor needs. Some apps provide robo-advisory services, offering automated investment management based on user preferences and risk tolerance, while others offer full-service brokerage services with access to financial advisors.

3. What are exchange-traded funds (ETFs)?

Exchange-traded funds (ETFs) are investment funds that trade on stock exchanges, similar to individual stocks. ETFs typically hold a basket of assets such as stocks, bonds, or commodities and offer investors exposure to a diversified portfolio with the convenience of trading on the stock exchange.

4. What investment style do investment apps typically offer?

Investment apps typically offer a range of investment styles to suit different investor preferences and goals. Some apps focus on passive investing strategies, such as index fund or ETF investing, while others offer active management options with individual stock picking or thematic investing approaches.

5. What are mutual funds?

Mutual funds are investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Mutual funds are professionally managed and offer investors a convenient way to access diversified investment portfolios with varying levels of risk and return potential.

6. What are ETFs?

Exchange-traded funds (ETFs) are investment funds that are traded on stock exchanges, similar to individual stocks. ETFs typically track a specific index, commodity, or sector and offer investors exposure to a diversified portfolio of assets. ETFs are known for their low costs, tax efficiency, and flexibility, making them popular investment options for both novice and experienced investors alike.

7. What is the Securities Investor Protection Corporation (SIPC)?

The Securities Investor Protection Corporation (SIPC) is a nonprofit corporation established to protect investors’ assets held at brokerage firms in the event of a brokerage firm’s bankruptcy or insolvency. SIPC provides coverage for up to $500,000 in securities and cash (including $250,000 in cash) per customer account.

Take the first step toward achieving your financial goals

Indeed, there’s never been a better time to explore the world of investment apps. Thanks to modern technology, investing has become simpler and more accessible to everyone. With just a smartphone or computer, you can now start investing with ease.

And once you decide to try investing apps, remember that the best investment app for you will depend on your individual preferences, risk tolerance, and financial goals.

Take the time to assess your needs and financial capabilities. Arm yourself with the knowledge necessary to navigate the markets effectively and make informed decisions that align with your aspirations.

Do you want to invest in your own app idea? Contact us today to explore the possibilities. Your innovative app could be the next big thing in the world of finance and beyond.

See our reviews of other apps:

- 6 Best Budget Apps to Help You Master Your Money

- 5 Best Meditation Apps

- 5 Best Travel Apps

- 7 Best Workout Apps to Help You Sweat Smarter

- 5 Best Period Tracker Apps

- 6 Best Yoga Apps

- 6 Best Running Apps

- 7 Best Calorie Counter Apps

- 5 Best Health Tracking Apps

- 6 Best Fitness Tracker Apps

- 5 Best Intermittent Fasting Apps