5 Best Trading Apps in 2025

Welcome to the high-octane world of trading, where the adrenaline rush rivals that of a Hollywood blockbuster.

Picture yourself in the heart of Wall Street, amidst the chaos of flashing screens, ringing phones, and bustling traders. It’s a scene straight out of “Boiler Room.”

The good news is you don’t need a corner office on Wall Street to join the action. With the rise of trading apps, the world of finance is at your fingertips, ready to be conquered from the comfort of your own home or anywhere with an internet connection. We’ve listed five of these apps on this blog.

Here are the apps that made it to our list:

- Interactive Brokers: Best overall trading app

- Stash: Best trading app for micro-investing

- Schwab: Best for customized trading experience

- Public: Best for active traders

- SoFi: Best for diversifying investment portfolios

How we came up with the list

To compile our list of the five best trading apps, we evaluated each based on factors such as user experience, features, innovation, accessibility, and overall value proposition.

It’s crucial to note that the information we provide here is for educational purposes only. The inclusion of apps in the list doesn’t imply endorsement or recommendation by our team at Appetiser.

Stock trading involves risks and may not be suitable for everyone. The value of investments can fluctuate and may result in losses. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before engaging in stock market trading.

Additionally, seeking advice from a qualified financial advisor is recommended to ensure that you understand the potential risks and rewards associated with stock trading. Please review the terms, fees, and features of any trading or investment app carefully before use.

With that said, let’s dive into the selected investing apps.

The 5 Best Stock Trading Apps

1. Interactive Brokers: Best overall trading app

Source: Interactive Brokers

Interactive Brokers is a trading app owned by one of the largest online brokerage firms in the U.S. The company’s founder, Thomas Peterffy, pioneered electronic trade (e-trade) in the financial market.

What sets the Interactive Brokers app apart is its advanced features. With the app, you have access to intuitive mobile and desktop platforms that allow you access to real-time quotes, charts, and market scanners. These features enable you to conduct in-depth market analysis, execute trades, and manage portfolios with ease.

Another thing that makes Interactive Brokers stand out is its trial option. The platform offers a unique opportunity to take their mobile app for a test drive. With no registration or username required, you can log in and access unlimited delayed quotes. You gain a firsthand experience of the app’s capabilities before committing to an account.

Interactive Brokers has a 5.0 and 4.8 rating on the App Store and Google Play respectively.

Device Compatibility:

- iOS

- Android

Pricing:

- Free to download and use app

- $0 annual, account, transfer, or closing fees

- Additional fees for trading

Pros:

- Features advanced platforms with real-time data for informed trading decisions

- Offers diverse financial products

- Global traders can access 90+ stock markets worldwide

Cons:

- May be overwhelming for beginners due to its advanced features

- Some account types require minimum balances

- Access to certain features or markets may be restricted, depending on the user’s location

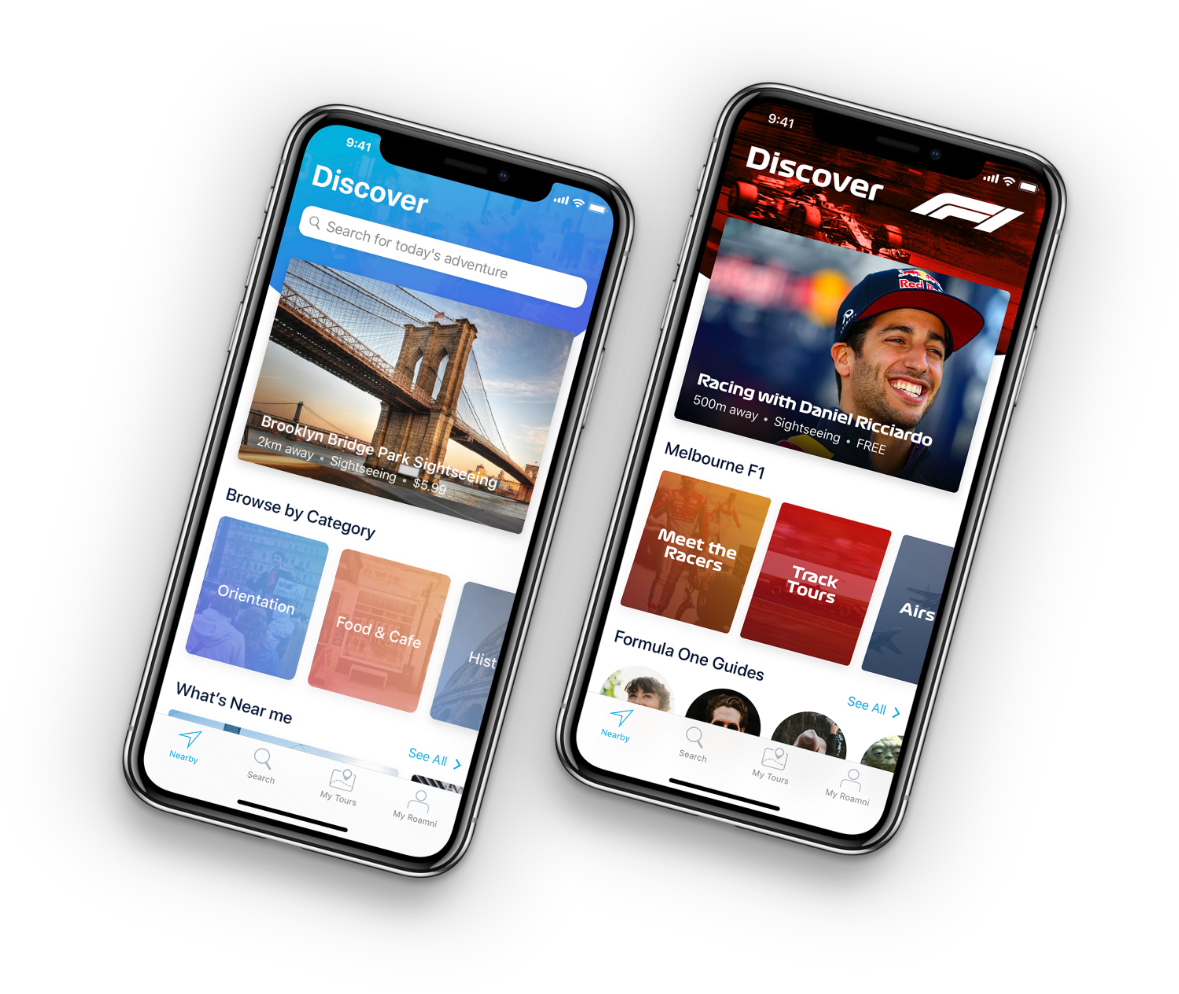

2. Stash: Best trading app for micro-investing

Source: Stash

Stash aims to make investing accessible and affordable for everyone with its micro-investing features, which allow users to invest in small amounts gradually. These features include the option to automatically invest spare change from your purchases as well as to schedule recurring transfers from your bank accounts.

Additionally, Stash allows users to buy fractional shares of stocks and exchange-traded funds (ETFs), which means you can invest in companies or assets that have high share prices with just a small amount of money. For example, if a share of a stock costs $100, but you only have $10 to invest, Stash will allow you to purchase 0.1 of a share.

Another thing that users appreciate most about Stash is its user-friendly and intuitive design. The app also affords you the flexibility to proceed at your own pace. Stash has garnered 4.7 and 3.7 ratings in the App Store and Google Play respectively.

Pricing:

- Free to download and use the basic features

- Stash Growth: $3/month – Includes access to investing, the Stock-Back® Card, banking features, budgeting tools, personalized advice, automated investing (Smart Portfolio), and a retirement account with tax benefits.

- Stash+: $9/month – Includes everything in Stash Growth plus premium advice and children’s investment accounts.

Pros:

- No commission fees on stock and ETF trades

- Fractional share investing allows for affordable investment in high-priced stocks

- Automated investing features, like recurring investments and round-ups, help users save and invest effortlessly

Cons:

- Monthly subscription fees may be a deterrent for some users

- Limited selection of investment options compared to some other platforms

- Additional fees may apply for certain features or services

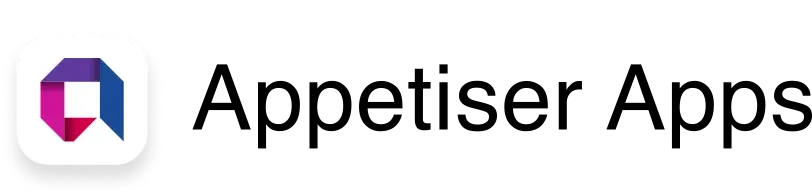

3. Schwab: Best for customized trading experience

Source: Schwab

Schwab is a mobile stock trading app developed by The Charles Schwab Corporation, a multinational brokerage and financial services firm in the U.S. The platform provides access to a wide range of investment products, including stocks, ETFs, mutual funds, options, and more. It has a rating of 4.8 on the App Store and 2.4 on Google Play.

Among the key differentiating factors of Scwab is its adaptable app experience. You can tailor it to suit your preferences with customizable features such as personalized watchlists of stocks and drag-and-drop modules.

Whether you’re experienced in active trading, just starting, or want to set-and-forget experience, the Schwab mobile app can be customized to meet your unique needs and preferences.

Additionally, Schwab offers a wealth of research and analysis tools aiming to help you make informed investment decisions. From real-time market data and in-depth research reports to customizable watchlists and interactive charts, the platform provides insights to stay up to date with market trends and identify potential opportunities.

Device Compatibility:

- iOS

- Android

Pricing:

- Free to download and use basic features

- Online listed stock: Commission-free

- Online options trades: $0.65 per contract

- Service charges apply for certain transactions

Pros:

- Transparent pricing and low costs

- Comprehensive account options to meet diverse needs

- Convenient mobile investing features and trading tools for easy access and management

Cons:

- Lacks price alert option within the app

- Requires higher minimum investment amounts for certain accounts or features

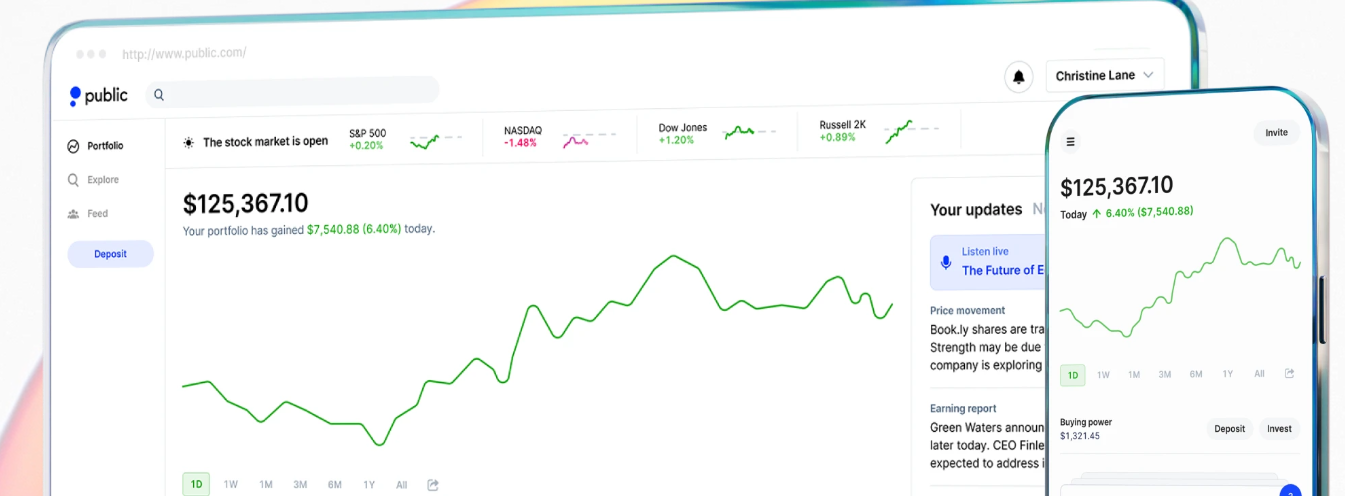

4. Public: Best for active traders

Source: Public

Public is a trading platform that leverages AI technology to provide investors with data-driven insights and analysis. It has a rating of 4.7 on the App Store and 4.2 on Google Play.

One notable feature of the app is Alpha, an AI-powered assistant that you can ask detailed questions about any stock or bond. This AI-driven functionality enables you to conduct in-depth analyses of assets and get real-time investment context and insights. You can also ask for information on market trends, company performance, or trading strategies.

Another key distinguishing feature of Public is its transparent revenue sharing. The platform shares 50% of its options revenue directly with its users, making it the cheapest way to trade options in the market.

Device Compatibility:

- iOS

- Android

Pricing:

- Free to download and use app

- No maintenance, trading, or commission fees

- Potential charges associated with some trading activities and transactions

Pros:

- Shares 50% of its options revenue directly with users

- Provides a high-yield cash account

- Offers AI-powered, real-time investment insights and analysis

Cons:

- Potentially limiting support for investors seeking hands-on assistance

- Lack of human advisor insight could be a drawback for users preferring traditional guidance

5. SoFi: Best for diversifying investment portfolios

SoFi (short for Social Finance) SoFi integrates the features of stock trading, automated investment advisor, and social trading in one app. It has a 3.7 rating on the App Store and 3.8 on Google Play.

The app offers access to over 15,000 U.S. and Hong Kong stocks and ETFs with a $0 commission on Hong Kong trades. Additionally, SoFi supports multi-currency deposits and offers in-app currency conversion services.

Another key feature of the SoFi app is its robo-advisor. This automated investment tool creates diversified portfolios tailored to your risk tolerance levels, making investing hassle-free. SoFi also offers extended hours in trading U.S. stocks. This affords you the flexibility to seize investment opportunities beyond regular market hours.

Device Compatibility:

- iOS

- Android

Pricing:

- Free to download and use app

- Potential charges associated with some trading activities, services, and transactions

Pros:

- All-in-one app integrating stock trading, robo-advisor, and social trading features

- Quick and easy account opening process, taking under 10 minutes

- Diversified portfolios tailored to users’ risk tolerance levels

Cons:

- Restrictions may apply to fractional shares, limiting investment flexibility

- Limited availability of certain features in some regions may impact user experience

Frequently Asked Questions About Trading Apps

1. How can beginners learn how to trade stocks?

Beginners can learn how to trade stocks through various resources such as online courses, books, tutorials, and demo accounts provided by trading platforms. Additionally, many online brokers offer educational resources and seminars for novice traders.

2. How do I buy stocks online?

Buying stocks online involves opening an account with a brokerage firm, funding the account, researching and selecting stocks to purchase, and placing an order through the broker’s trading app or platform. The process typically includes specifying the number of shares to buy and the desired price.

3. Is online trading safe?

Online trading can be safe if conducted through the platforms of reputable and regulated brokerage firms. It’s essential to choose a brokerage that employs robust security measures to protect users’ personal and financial information. Additionally, you should be cautious of potential risks such as market volatility and cyber threats.

4. What are the risks associated with trading stocks?

Trading stocks involves various risks, including market volatility, economic downturns, company-specific risks, and regulatory changes. As an investor, you should be aware of the potential for loss of capital and should consider diversifying your investment portfolios to manage risk effectively.

5. Do I need a lot of money to start trading stocks?

No, you don’t need a large sum of money to start trading stocks. Many brokerage firms offer low minimum deposit requirements, allowing investors to begin with a modest amount of capital. Additionally, fractional share investing and micro-investing platforms enable individuals to invest small amounts of money in stocks.

Embracing the Future of Finance

The rise of trading apps represents a significant shift in the way we approach finance and investing. With the power of technology at our fingertips, we are no longer restricted by traditional barriers to entry into the financial markets. Instead, we have the freedom to make informed investment decisions and pursue our financial goals with confidence.

As technology continues to evolve, we can expect trading apps to play an increasingly vital role in shaping the way we invest, save, and build wealth for years to come.

Looking to invest in your own trading app idea? Reach out to us to explore the possibilities. Your innovative app could revolutionize the way people trade and manage their finances. Don’t miss the opportunity to be a part of the future of trading technology!

See our other review of apps!

- 6 Best Budget Apps to Help You Master Your Money

- 7 Best Investment Apps in 2025

- 5 Best Meditation Apps

- 5 Best Travel Apps

- 7 Best Workout Apps to Help You Sweat Smarter

- 5 Best Period Tracker Apps

- 6 Best Yoga Apps

- 6 Best Running Apps

- 7 Best Calorie Counter Apps

- 5 Best Health Tracking Apps

- 6 Best Fitness Tracker Apps

- 5 Best Intermittent Fasting Apps