6 Best Budget Apps to Help You Master Your Money in 2025

Struggling to keep your finances in check? Frustrated with the endless cycle of overspending and under-saving?

Let’s face it. Managing finances can be daunting. From keeping track of expenses to setting savings goals, it’s easy to feel like you’re drowning in a sea of numbers and receipts. But thanks to modern technology, taking charge of your financial life is now as easy as a few taps on your phone.

Fact. MR found that the personal finance mobile app market is experiencing substantial growth, with personal finance apps hitting downloads of 1.3 billion in the second quarter of 2020.

More and more people are also relying on these apps for managing their finances. According to the same study, more than 75% of smartphone users globally have used at least one app to manage their finances.

But with many budgeting apps in the App Store and Google Play, how do you choose the one that suits your needs?

To help you streamline your financial life and make budgeting a breeze, we’ve reviewed six of the top budgeting apps in the market.

Our list is made by our team of app development specialists and strategists who have built successful apps. We look at things like how unique and innovative the app is, how well it works, how safe it is, how easy it is to use, and how much people like it. Additionally, we’ve considered each app’s value for money.

Here are the apps that made it to our list:

- Goodbudget: Best for family budget planning

- YNAB: Best for tracking and improving spending habits

- PocketGuard: Best for optimizing budget

- Honeydue: Best budgeting app for couples

- EveryDollar: Best budget app for funds allocation

- Expensify: Best budget app for startups and entrepreneurs

Read on to empower yourself with the right tools that can help you build a brighter financial future.

The 6 Best Budgeting Apps in 2025

1. Goodbudget: Best for family budget planning

Source: Goodbudget

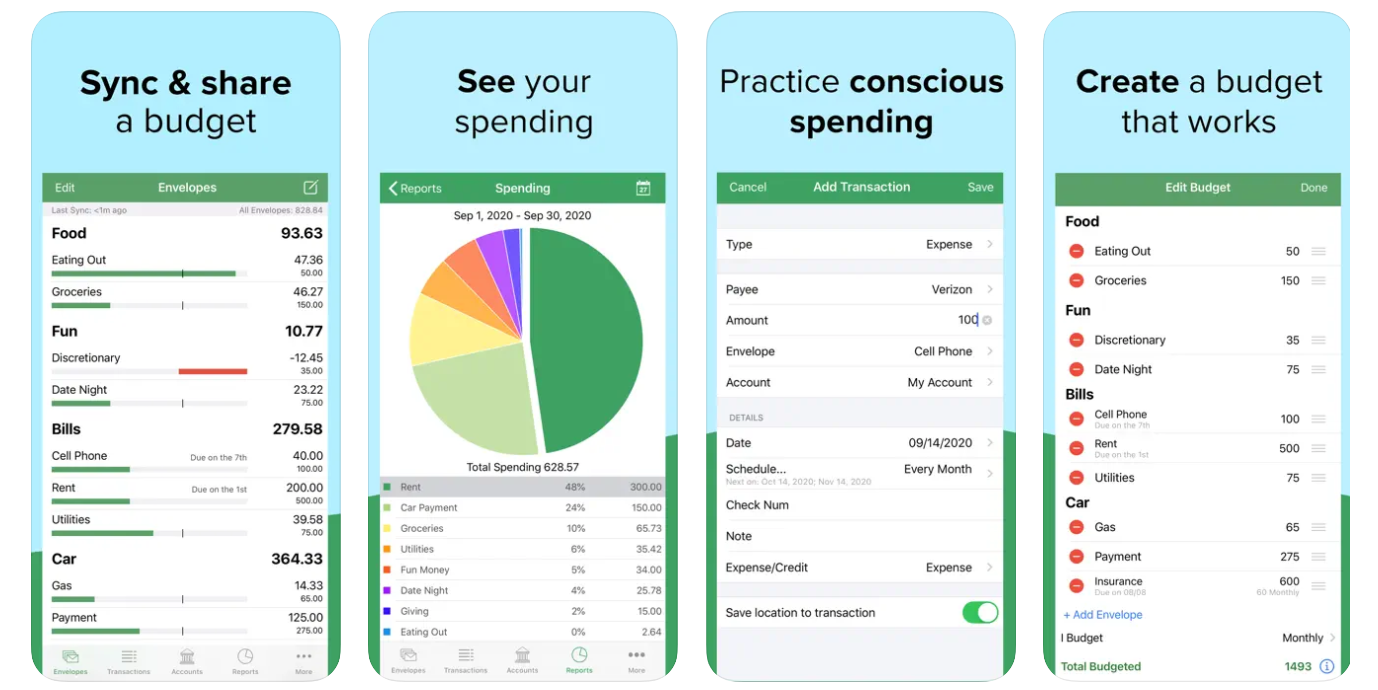

Goodbudget aims to help you keep track of your expenses and stick to your budget easily. Based on the proven envelope budgeting method, the app allows you to allocate funds to virtual envelopes for different spending categories.

One of the key features of Goodbudget is its reporting tools, which offer valuable insights into your spending habits. These reports enable you to comprehensively analyze your financial data, identify trends, and make informed decisions to improve your financial health.

Goodbudget also offers seamless budget-sharing functionality across multiple devices. This feature makes the app ideal for couples, families, or friends who want to collaborate on managing finances together. With transactions synced to the cloud and accessible from various devices, you can easily stay coordinated and on top of your finances.

Device Compatibility:

- Android/iOS

Pricing:

- Free Forever version includes 10 regular envelopes & 10 annual envelopes

- Paid subscription option starts at $5.99 per month

Pros:

- Seamless budget sharing across multiple devices

- Insightful reports for informed decision-making

- Based on the proven envelope budgeting method

Cons:

- Requires manual input for transactions

- Reporting features are relatively basic compared to some other budgeting apps

- Option to integrate with bank accounts may be limited to some financial institutions

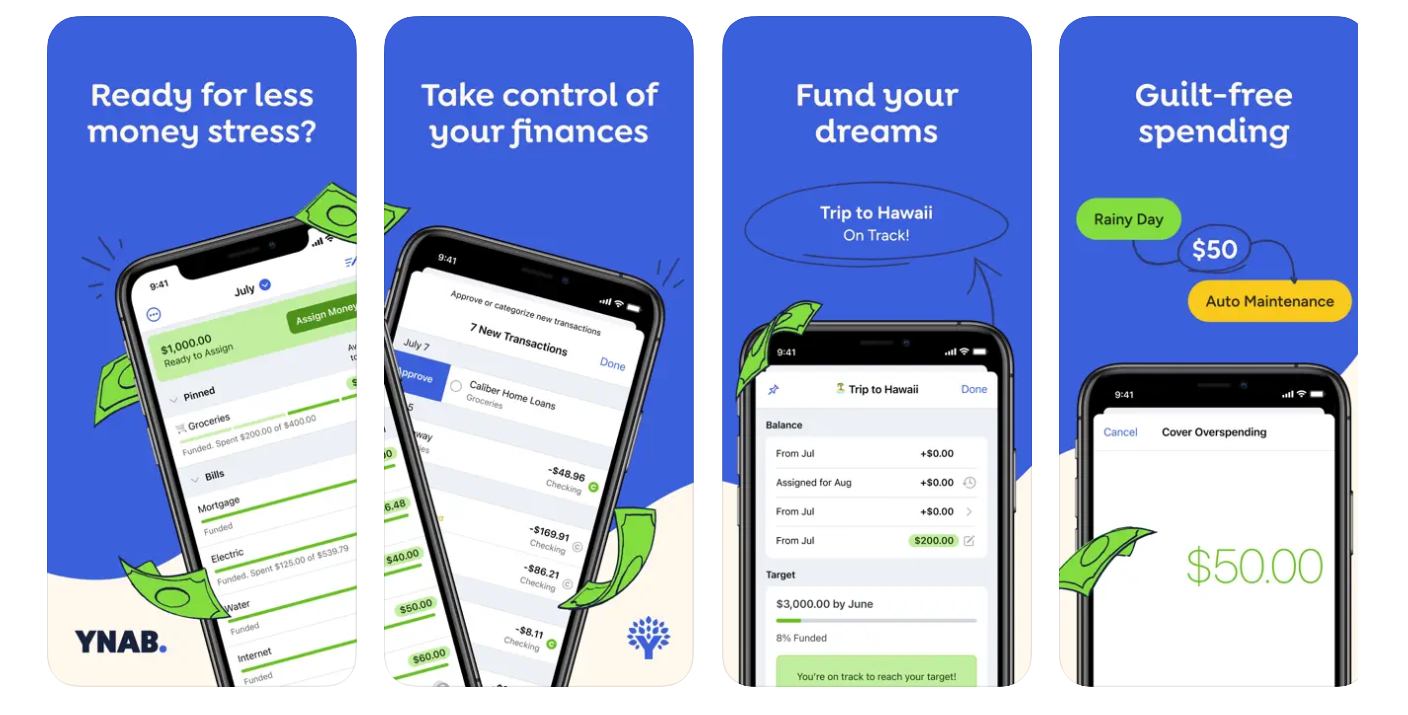

2. YNAB: Best for tracking and improving spending habits

Source: YNAB

YNAB (You Need a Budget) offers a comprehensive system aimed at changing your financial habits for the better. It provides features such as real-time expense tracking, goal setting, and collaborative budget sharing.

What sets YNAB apart is its focus on behavior change. Rather than simply providing a platform for budgeting, YNAB guides you through rethinking your spending habits and priorities.

Its goal-setting features help you align your financial decisions with your long-term aspirations, while its collaborative budget-sharing functionality fosters transparency and accountability within partnerships and families.

With real-time insights into your spending and taking control over your debts, you are better poised to make informed decisions and take control of your financial future.

Pricing:

- Free trial (30 days)

- Monthly subscription: $14.99

- Annual subscription: $98.99

Device Compatibility:

- iOS

- Android

Pros:

- Efficient zero-based budgeting

- Real-time transaction tracking

- Educational resources for developing better financial habits

Cons:

- Lack of robust features for tracking investment accounts

- Subscription costs may deter customers looking for free budgeting apps

- Limited option to link bank accounts

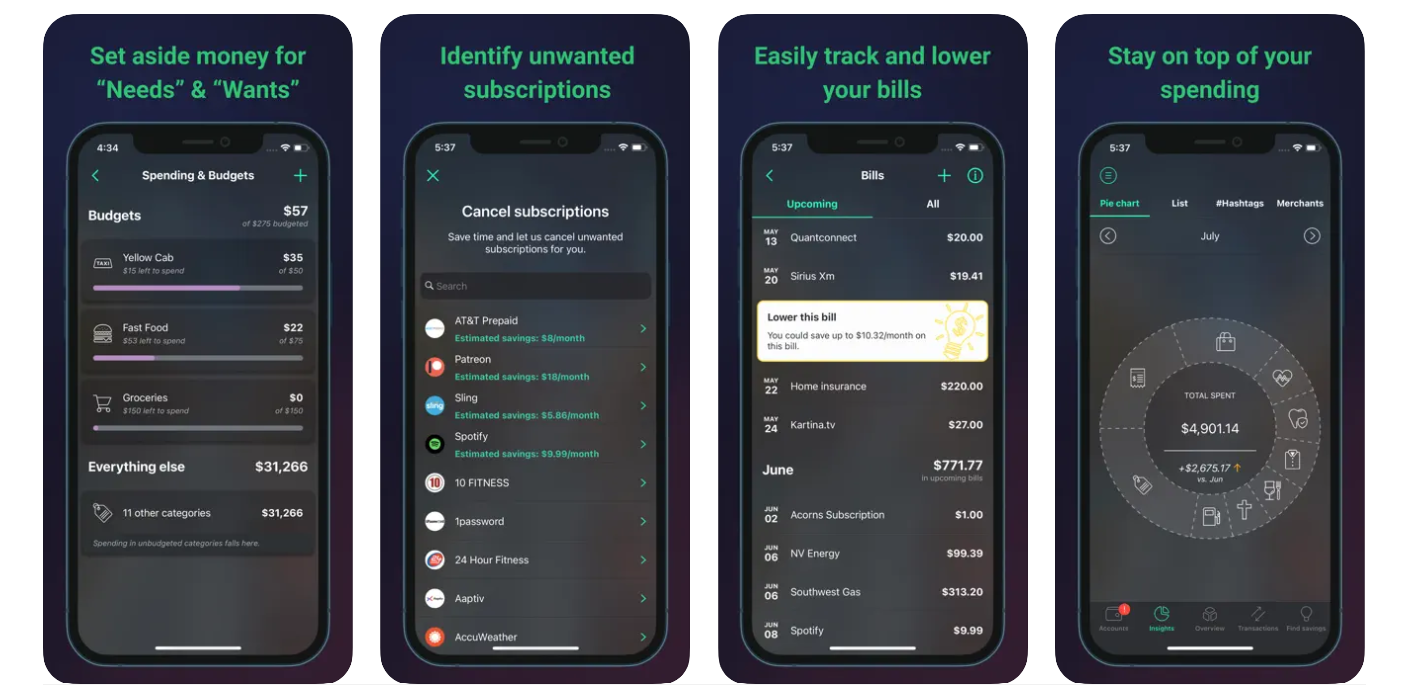

3. PocketGuard: Best for optimizing budget

Source: PocketGuard

PocketGuard is a budget app that aims to liberate users from the tedious aspects of money management. It automates routine tasks like expense tracking and bill monitoring, allowing you to focus on making informed decisions and achieving your financial goals.

One of the standout features of PocketGuard is its “IN MY POCKET” functionality, which calculates your disposable income after accounting for bills, savings, and spending needs. This allows you to determine your safe-to-spend amount and manage your monthly budget.

Additionally, PocketGuard offers comprehensive analytics to help you understand your spending habits and make necessary adjustments. The app also serves as a bill organizer and subscription manager, ensuring you never miss a payment. You can optimize your budget as well by identifying unnecessary expenses.

PocketGuard ensures the safety of users’ sensitive financial information by using 256-bit SSL encryption and biometric authentication.

Device Compatibility:

- iOS

- Android

Pricing:

- Free version available with essential features

- Monthly subscription: $12.99

- Annual subscription: $74.99

Pros:

- Provides comprehensive analytics and reporting

- Simplifies personal finance management with intuitive design and automation

- Uses a high standard of data protection and safety similar to what banks use

Cons:

- Some users may find the premium subscription price to be steep

- Limited to U.S. and Canadian financial institutions

- Requires active management to fully utilize its features

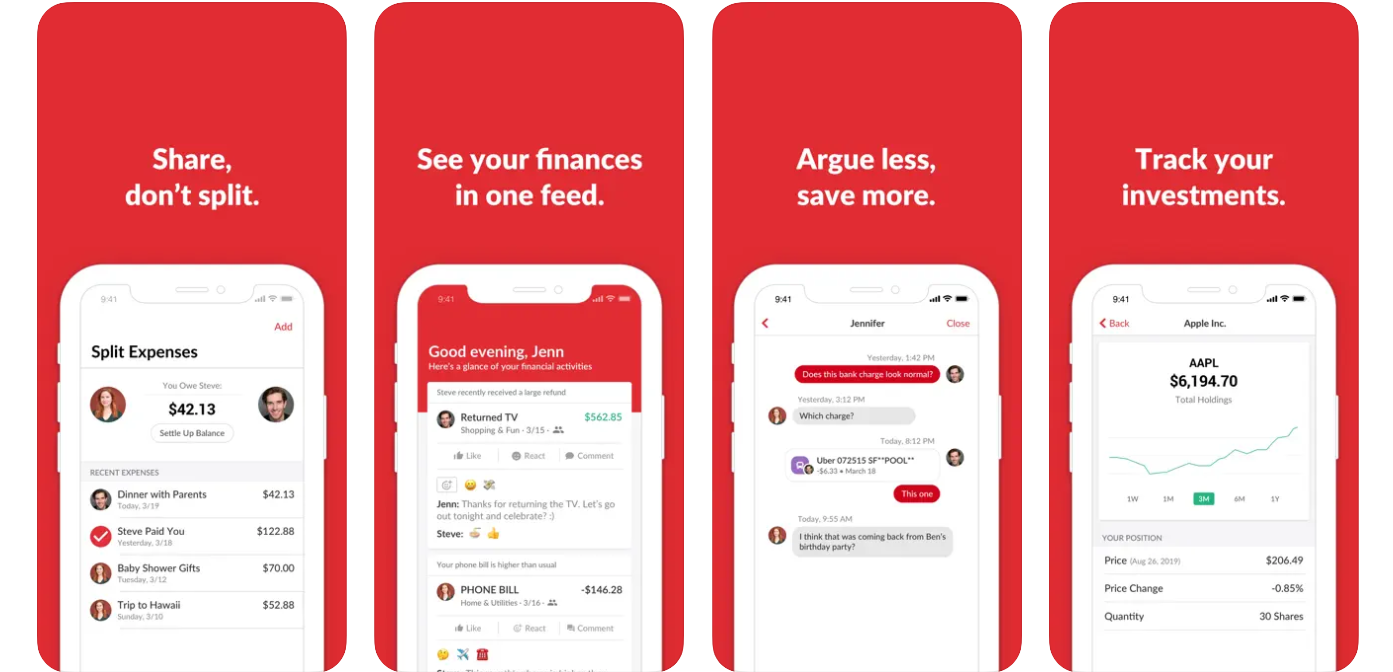

4. Honeydue: Best budgeting app for couples

Source: Honeydue

Honeydue is a free budgeting app that aims to simplify money management for couples. Tracking balances, budgets, and bills together becomes a delightful task.

Beyond just tracking balances and bills, Honeydue encourages couples to engage in meaningful discussions about their financial goals and spending habits. The app empowers you and your partner to manage your finances proactively while respecting each other’s autonomy.

With customizable spending limits and bill reminders, Honeydue lets you set monthly spending limits, receive notifications when nearing these limits, and even customize categories to suit your specific needs.

Additionally, Honeydue also notifies couples when payments are due so they can divide expenses and settle them immediately.

Pricing:

- Free

- Option to subscribe to Monthly Tip starts at $0.99

Device Compatibility:

- iOS

- Android

Pros:

- Facilitates transparent communication and collaboration between partners

- Provides a comprehensive overview of finances, including bank account balances and bill reminders

- Offers robust security features to protect user’s sensitive financial information

Cons:

- Limited to users in the United States

- Some users may prefer more customization options for budgeting categories

- Occasional syncing issues reported by a small number of users

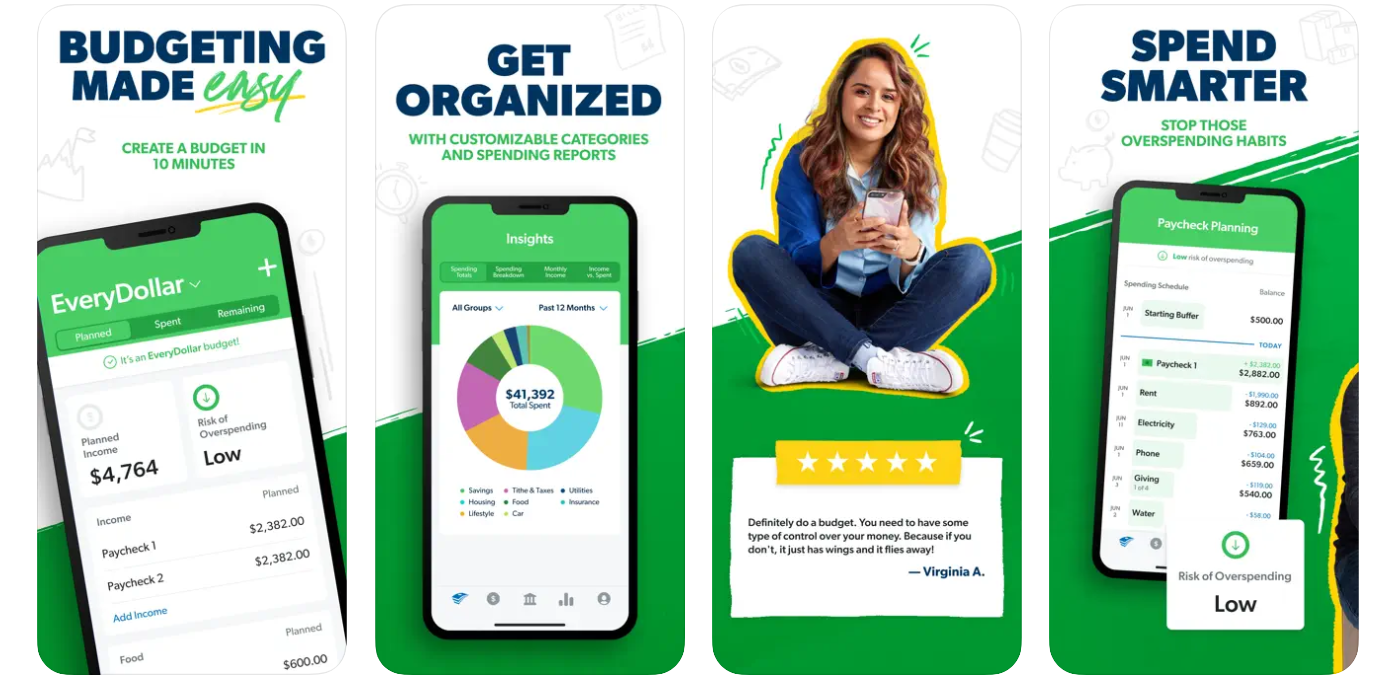

5. EveryDollar: Best budget app for funds allocation

Source: EveryDollar

Developed with the belief that budgeting should be accessible and empowering, EveryDollar helps you take control of your money without the need for complicated spreadsheets or math. It has a user-friendly interface and intuitive features that make budgeting accessible, regardless of your financial background or expertise.

Another appealing aspect of EveryDollar is its zero-based budgeting method, which ensures that every dollar has a specific purpose before the month begins. This straightforward approach allows you to allocate funds to various categories and track spending with ease.

Additionally, EveryDollar’s premium version has received praise for its advanced tools and personalized coaching, making it a top choice for those serious about transforming their financial future.

Pricing:

- Free (with essential features)

- Free premium version trial (14 days)

Device Compatibility:

- Android

- iOS

Pros:

- Empowers users to take control of their finances with zero-based budgeting

- Offers advanced features and personalized coaching with premium version

- Continuously evolves to meet the needs of its users and provide a seamless budgeting experience

Cons:

- Premium version requires a subscription after the 14-day trial

- Some users may find advanced features overwhelming at first

- Limited to users in certain countries, with bank connectivity available in select regions

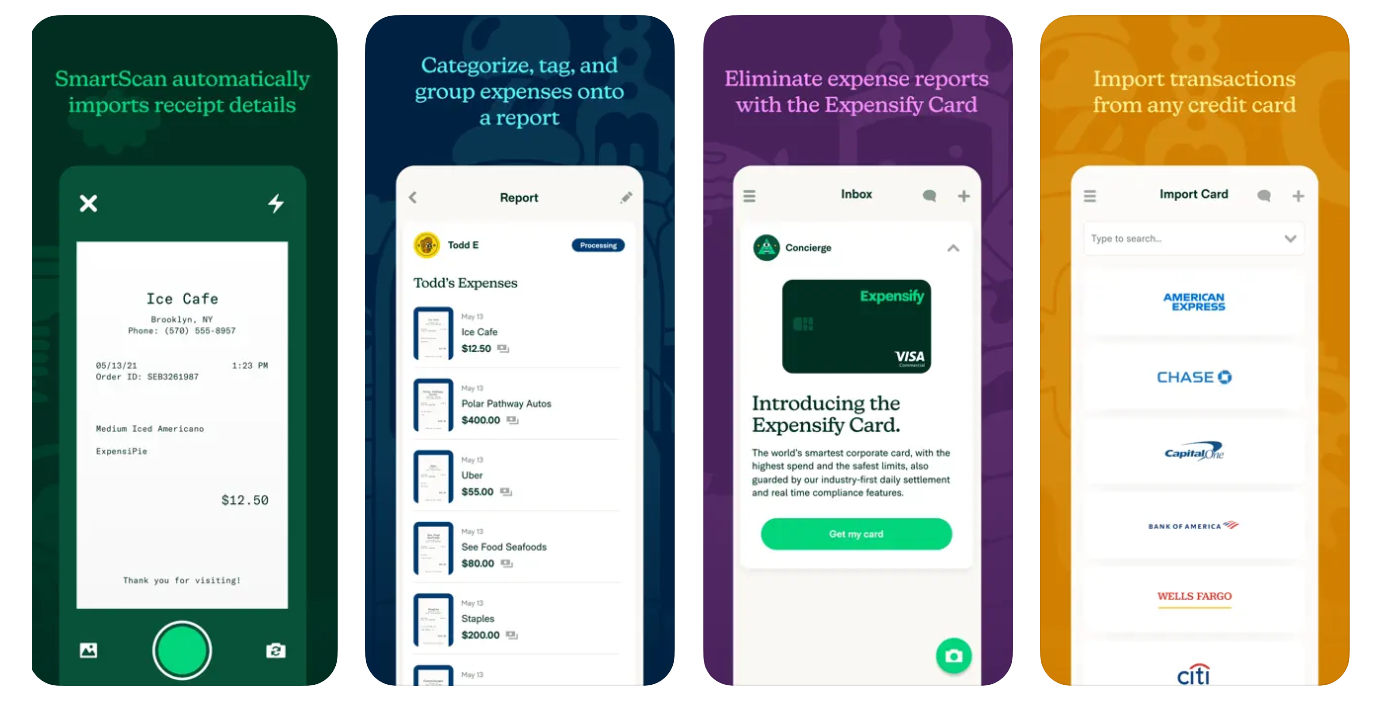

6. Expensify: Best budget app for startups and entrepreneurs

Source: Expensify

If you’re a business owner looking to streamline financial management, Expensify can be something worth exploring. This budgeting app aims to simplify the process of tracking expenses, receipts, and travel expenses for businesses and individuals alike.

One standout feature of Expensify is its SmartScan technology, which swiftly captures and organizes receipts accurately. This feature not only reduces manual data entry but also ensures that every expense is recorded for thorough financial tracking. It also offers multi-level approval workflows that allow you to automate your expense policies.

Another convenient feature of the app is its multi-currency support. This functionality makes it easy to reimburse your employees and manage all other expenses, regardless of where you are in the world. You can keep track of your expenses in your preferred currency and convert it automatically to another.

Additionally, Expensify integrates seamlessly with popular productivity tools like Xero, NetSuite, and Quickbooks, and Uber.

Pricing:

- Free version available

- Pricing tiers available for different needs, starting from a beginner tier with a low monthly cost.

Pros:

- Streamlined receipt capture and organization with SmartScan technology.

- Customizable expense categorization and tags for personalized financial tracking.

- Seamless integration with popular accounting and finance tools, enhancing productivity.

Cons:

- Subscription-based model may not be suitable for budget-conscious users.

- Some users may find the extensive features overwhelming initially.

- Integration with certain financial institutions may be limited, affecting functionality for some users.

FAQs about budget apps

1. What is a budget app?

A budget app is a software application designed to help individuals or households manage their finances by tracking income, expenses, and savings goals.

2. How can a budget app help me?

A budget app can help you gain insight into your spending habits, set financial goals, track your expenses, and ultimately, manage your money more effectively.

3. What features should I look for in a budget app?

Look for features such as expense tracking, customizable budget categories, goal setting, bill reminders, synchronization across devices, and reporting tools for analyzing your financial behavior.

4. How do I choose the best budget app for me?

Consider factors such as your specific financial goals, preferred budgeting method, ease of use, compatibility with your devices, and any additional features or integrations you may require. Reading user reviews and trying out demo versions can also help you make an informed decision.

5. Are budget apps free?

Many budget apps offer free versions with basic features, while others may require a subscription for access to advanced functionalities or to remove ads. Explore different options to find the best fit for your needs and budget.

Fuel financial success with technology

The era of complicated spreadsheets and financial guesswork is behind us. With the best budgeting tools at your disposal, managing money has never been easier or more accessible.

So whether you’re looking to reign in overspending, follow a data-based personalized spending plan, boost your savings, or simply gain better insight into your financial habits, there’s a budgeting app out there to help you achieve your goals.

Remember that the key to financial health lies in consistency, discipline, and a willingness to embrace tools and technologies that work for you.

Here’s to a brighter, more prosperous tomorrow!

Speaking of…

Do you have a million-dollar app idea? Our team of Silicon Valley founders, specialists, and strategists can help you turn it into a reality. We’ve done the same for clients like Vello, Youfoodz, and MyDeal — building and growing their apps from zero to multi-million dollars and hundreds of thousands of users.

Contact us to learn how we can do the same for you.

See our other review of apps!

- 7 Best Investment Apps in 2025

- 5 Best Meditation Apps

- 5 Best Travel Apps

- 5 Best Trading Apps

- 7 Best Workout Apps to Help You Sweat Smarter

- 5 Best Period Tracker Apps

- 6 Best Yoga Apps

- 6 Best Running Apps

- 7 Best Calorie Counter Apps

- 5 Best Health Tracking Apps

- 6 Best Fitness Tracker Apps

- 5 Best Intermittent Fasting Apps

Jane Eslabra has 14+ years of experience producing content across traditional and digital platforms. She channels her strong passion for fostering tech startup growth through knowledge sharing.