5 Best Stock Apps in 2025

Are you a saver or an investor?

You can also be both. If you have enough funds in your nest for savings and emergency funds, you’re off to another exciting financial journey, and that’s why you’re searching for the best stock apps.

Here’s a reality check: The average interest rate on savings accounts is 0.46% Annual Percentage Yield (APY), and if you find high-yield savings, they can give you 1.00% to 5.00% APY tops. On average, inflation is now at 5.20% globally, which is eating up your money.

If you do the math, it’s simple — money doesn’t grow in the bank. It multiplies in intelligent investors who aim to make money work for them through different combinations of investments like real estate, mutual funds, active trading, exchange-traded funds (ETFs), stocks, and of course, the big word: patience.

In this article, I’ll share the best stock apps in 2024 that will empower you to make better decisions on where to put hard-earned money.

Here are the best stock trading apps that made it to our list:

- Vanguard: Best for Beginner and Experienced Investors

- Stock Rover: Best for Stock Research and Analysis

- SaxoTraderGo: Best for Global Stock Trading

- Fidelity: Best for All-in-One Stock and Money Management

- eToro: Best for Social Trading

How We Came Up With the Best Stock Trading App List

We’ve selected the five best stock apps by assessing their accessibility to traders and investors, user experience, features, innovative functionality, and overall value.

Keep in mind that this guide is for informational purposes only. Inclusion in the list doesn’t signify endorsement by the Appetiser team.

Trading stocks and investing involve risk and may not be everyone’s cup of tea. Investments can fluctuate, leading to losses. At the end of the day, you should clearly understand your investment goals, risk tolerance, and financial situation before entering the stock market.

While these apps are designed to optimize portfolio returns, we strongly recommend consulting with your financial advisor for tailored guidance on financial matters. Consulting a financial advisor can help you grasp the risks and rewards of stock trading.

Lastly, review app terms, fees, and features diligently before use.

Now, let’s explore each stock trading app below.

1. Vanguard: Best for Long-Term Investors

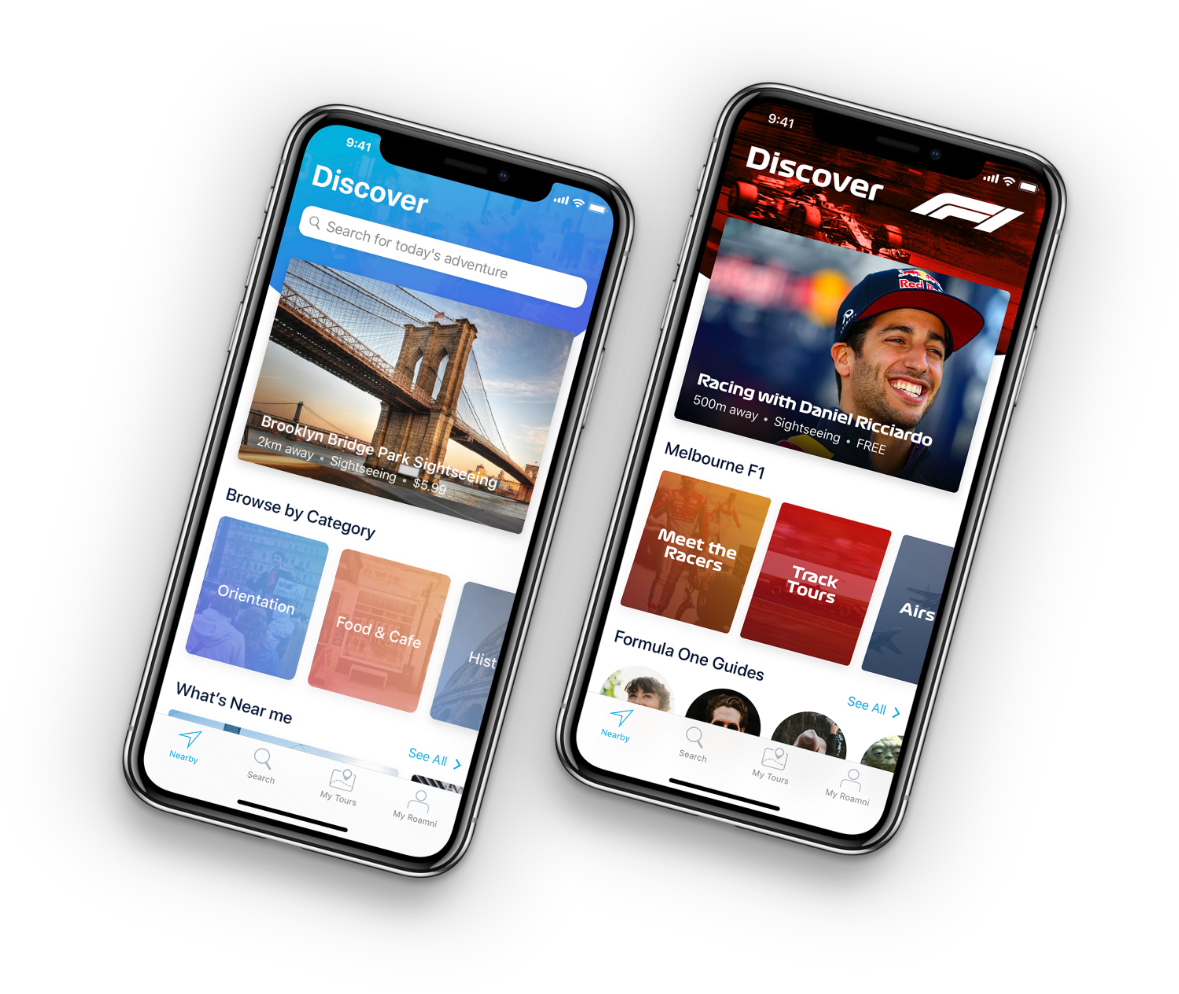

Source: Vanguard

Vanguard is an investment platform known for commission-free trading on stock and ETF trades and offers thousands of mutual funds with no transaction fees. It has a robo-advisor service known as Vanguard Digital Advisor, an automated financial advisor that relies on algorithms for a hands-off approach or automated investing.

This helps you invest your money without talking to a human financial advisor. It uses computer programs (algorithms) to decide the best way to invest money based on your goals.

Moreover, Vanguard pioneered index investing, offering low-cost index funds that allow investors to access a diversified portfolio with minimal risk. There are more than 3,000 mutual funds to choose from, making it attractive for long-term investors.

It’s a good stock app for beginners and experienced investors, as the app has a basic user interface for checking account balances, trading fund shares, and monitoring portfolios. You can access the latest market news and investment updates to help you make better financial decisions.

However, if you’re an active stock trader, you will find the platform lacking educational resources and technical tools, so might want to consider exploring other stock apps with comprehensive features.

Device Compatibility:

- iOS

- Android

Pricing:

- Free

- Minimum investment at $1,000, other mutual funds may require $3,000

Pros

- No commission fees for stock and ETF trades

- Extensive range of mutual funds with no transaction fees

- Access to retirement planning tools and financial advisors

- Strong emphasis on low-cost investing options

- Mobile app is user-friendly for basic trading

Cons

- Delayed display of stock quotes, which is a drawback to active traders who need real-time price updates

- Some investment funds require a minimum investment of $3,000, which is too high for beginners

- Limited research tools compared to other brokerages

- Only offered to US residents with social security number

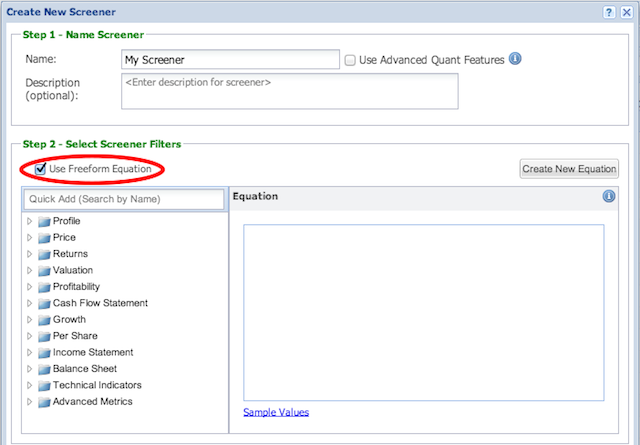

2. Stock Rover: Best for Stock Research and Analysis

Source: Stock Rover

Stock Rover is a leading investment research platform offering U.S. investors comprehensive technical and fundamental analysis insights. Active traders and investors can compare stocks, mutual funds, and ETFs with the app’s screening capabilities.

With its extensive data coverage on over 40,000 tickers — the unique codes and symbols for assigned stocks and securities traded — from major North American exchanges, investors can get up-to-date price information.

Another unique feature of Stock Rover is its Card layout in the web app. It gives users a colorful and succinct way to compare equities in a compact form, including nine different card layouts with information on various aspects like Analyst Returns, Dividend Yield, Earnings Surprise, Company Profile, and more.

Active traders will be delighted to access Stock Rover’s comprehensive charting capabilities and daily analyst ratings to better understand market movements. However, this stock app is more focused on providing information. Thus, it doesn’t support trading, where you can buy and sell stocks.

Device compatibility:

- Any web browser

- Web app on a tablet

Pricing:

- Free

- Stock Rover Essentials: $7.99 per month; $79.99 per year; and $139.99 for 2 years

- Stock Rover Premium: $17.99 per month; $179.99 per year; and $319.99 for 2 years

- Stock Rover Premium Plus: $27.99 per month; $279.99 per year; and $479.99 for 2 years

Pros:

- Extensive financial data coverage for beginners and experienced traders

- Powerful charting capabilities and comparison of stocks

- Portfolio management and detailed information on stock trades

- Free for life for the basic plan

Cons:

- No social community

- Doesn’t support trading option

- Limited to U.S. markets only

- Customer support is only available via email and very limited

- No iOS or Android version, you can use tablet to view Stock Rover features

3. SaxoTraderGo: Best for Global Stock Trading

Source: Tokenist

SaxoTraderGo is a web and mobile platform by Saxo Bank, a fully licensed and regulated Danish bank known for its user-friendly interface and advanced trading features.

Traders and long-term investors can access detailed account overviews of their stocks’ performance through the app. It has comprehensive research tools to help you analyze the markets and various trading characteristics like trade tickets, where you can execute their trades in real-time.

The charting packages can help you identify patterns and predict future price movements. The fundamental analysis tools also help you determine if the stock is overvalued or undervalued.

Notably, SaxoTraderGo’s charting capabilities are robust, with nearly 20 drawing tools and 62 indicators for efficient trading experience. Another good thing about SaxoBank is that it can cater to traders globally in over 15 countries worldwide, including the UK, the European Union, Singapore, Australia, Hong Kong, and others.

The commission fee for US stock trading is 0.08% of the trade value with a minimum of $1, but VIP pricing can reduce this commission to as low as 0.03% of the trade value with a $1 minimum.

Device compatibility:

- iOS

- Android

Pricing:

- Free

- Additional fees for trading

Pros:

- Global access to over 70,000 instruments

- Unified trading experience across devices like web and mobile apps

- Intuitive user interface for beginners and veteran traders

- Available to global traders and investors

Cons:

- Some traders find the fees comparatively higher than other stock apps

- Technical issues like delays in charts

- Limited cryptocurrency trading support

- Delayed quotes until an order ticket is opened

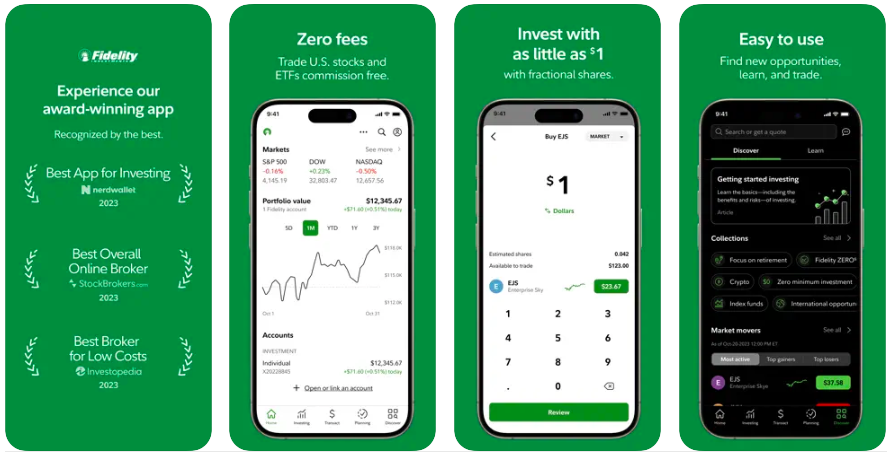

4. Fidelity: Best for All-in-One Stock and Money Management

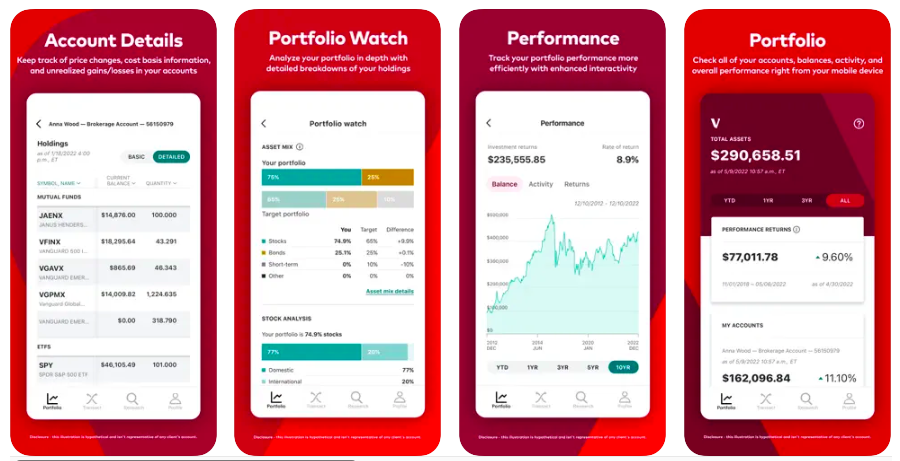

Source: Fidelity

Fidelity is an all-in-one stock and management app that offers trading options and money management tools, ideal for people who want to save and invest wisely. It has been recognized as the Best Online Broker for Beginning Investors and Best App for Investing by Nerdwallet, a US-based personal finance company.

The Fidelity app offers a comprehensive range of features, including real-time market data, customizable alerts, portfolio performance comparisons, and the ability to trade US stocks and ETFs with $0 commissions and no account minimums.

With its cash management option, you can track spending, pay bills, deposit checks, and seamlessly trade stocks while maintaining a secure environment with features like two-factor authentication, voice biometrics, and real-time alerts.

What makes Fidelity a standout when we compare it to Vanguard and SaxoTraderGO is its flexibility in customer support options. Fidelity offers 24/7 phone support and online chat (limited hours), plus an email portal. On top of that, users love the heatmap functionality that helps them visualize the holdings to assess portfolio performance in their investment accounts.

Device compatibility:

- iOS

- Android

Pricing:

- Free

Pros:

- Quality mobile and desktop trading platforms

- No minimum deposit required for retail brokerage account

- Excellent customer service

- Commission-free trading on US stocks and ETFs

- Access to fractional shares (buy a portion of stock or ETF than the whole share) for a minimum of $1.

Cons:

- Absence of cryptocurrency trading

- Lack of certain advanced features like futures trading for active traders

- Focused on U.S. traders and investors

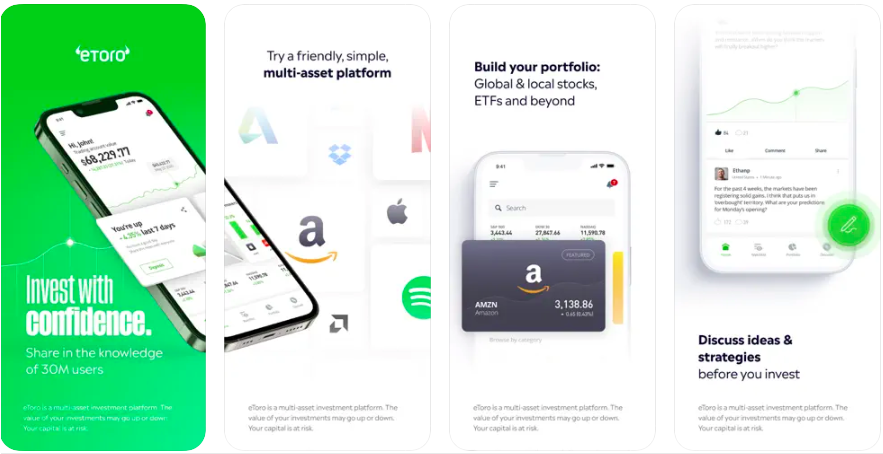

5. eToro: Best for Social Trading and Copy Trading

Source: eToro

eToro is a social trading platform that enables users to trade and invest in various assets, including cryptocurrencies and stocks, while being part of a global community. It provides smart investing tools, multiple asset options, and a social environment for users to interact and learn from each other.

A unique feature of eToro is its social investing aspect, which allows you to discuss markets, share insights, and even copy the trading strategies of successful investors. This feature makes it an ideal platform for beginners because they can learn from experienced traders and replicate their strategies.

Traders can use various filters to narrow down their search for other traders. These filters include country of origin, markets traded, percentage gains, time frame, risk profiles, and whether the results have been verified.

Say, you prefer a hands-off approach to investing. , You can copy a trader with excellent portfolio management and set a copy amount for trading. Remember that there’s also risk associated with this approach as this will also copy their stop-loss orders and closing options.

Device Compatibility:

- iOS

- Android

Pros:

- Social trading and copy trading features

- Diverse asset options including cryptocurrencies

- Interactive community for learning and sharing insights

- Commission-free trading for stocks and ETFs

Cons:

- Limited availability in certain countries due to regulatory restrictions

- High trading fees compared to other stock apps

- Withdrawal fee is set to $5 per transaction with minimum amount of $30

- Charges a currency conversion fee for deposits and withdrawals

- Charges inactivity fee of $10 per month

Grow Your Money: Leverage Mobile Apps to Achieve Financial Goals

Technology has made it possible for anyone to access investment opportunities, regardless of location, financial status, and background.

Apps have become a cornerstone of innovation and digital transformation among financial institutions and providers, which empower people to better manage their money.

For instance, the number of people in the US using stock trading apps has been on the rise. In 2021, over 150 million people were using retail investing apps, indicating a significant increase from previous years. More than half of US adults (158 million or 61% of U.S adults) own stock, although most do not own substantial amounts, with the wealthiest 1% holding a significant portion of stocks.

Indeed, there’s no shortage of people using these stock apps. With zero commissions mobile apps are being made accessible, there’s no better time than today to help other people build their wealth.

Do you have a fintech app in mind? Maybe this is a sign for you to democratize money and finances that could impact people’s narrative, locally or even globally.

Contact Appetiser today and make this your day one of your finance app success.

See our other review of apps!

- 7 Best Investment Apps in 2025

- 5 Best Trading Apps in 2025

- 6 Best Budget Apps to Help You Master Your Money in 2025

- 8 Best Ecommerce Apps

- 8 Best Shopify Mobile Apps

- 5 Best Meditation Apps

- 5 Best Travel Apps

- 5 Best Health Tracking Apps

Maria Krisette Lim is a Content Marketing Specialist with 14 years of experience producing web and print ad content. Krisette has a BSBA degree, major in Business Management and Entrepreneurship. When she’s not tinkering with words and punctuation, she’s either curled up with a book while sipping hot tea, playing with her toddler, or tinkering with website builders.