4 Unique Startup Funding Options to Scale Smarter, Faster

Did you know that NOT ALL business financing requires cash payment?

Startups, in particular, can take advantage of unconventional financing arrangements. These flexible payment options come in handy, especially during external shocks like pandemics and economic crises.

I have classified startup funding options into four unique ways you could pay for them. Once you realize how flexible financing options are, you could be on your way to building a startup that could earn billions while making a positive impact on the world.

Without further ado, let’s dig into these financing options. But first, a quick discussion on startup funding.

What is startup funding?

Startup funding is the money raised by an innovative business to kickstart or sustain its operations.

All businesses need financing of some sort. But since startups significantly improve or make new products and services, their funding needs tend to differ slightly from conventional companies.

Hence, special funding vehicles have been developed for startups. I will tackle these in the next section of this article.

4 Uncommon Ways to Pay for Startup Funding

Contrary to popular belief, high-interest bank loans aren’t the only financing options available. Many startup business funding options are payable through cash and non-cash methods, which include:

- Open-ended payment options

- No payment required

- Optional non-cash payback

- Definite cash payment

Let’s begin with the most flexible method, the open-ended payment options.

Funding payment scheme 1: Open-ended payment

Open-ended means that you have no strict obligation to pay the funder in cash.

This scheme is extremely useful if you do not like others forcing their payment terms on you.

Examples of funding sources with this payment scheme include:

- Yourself

- Friends and family

- Donation crowdfunding

Self-funding

Also known as bootstrapping, self-funding involves raising your own capital by saving a part of your salary or dipping into your retirement fund (like the American 401k, Australia’s super fund, etc.).

Many startups that began as bootstrapped businesses eventually became multi-million-dollar enterprises. The creator of the healthy snack brand Chomps initially self-funded his business. Now, the company earns around $100 million.

MyDeal enjoyed similar success. The Australian e-commerce brand wanted to reach more buyers through a mobile app we helped develop. Through that app, MyDeal turned from being bootstrapped to a company worth around $200 million. Read the MyDeal case study to learn more about this.

Friends and family

Getting funds from your loved ones tends to be easier than going to banks or other institutions.

After all, if you built an intimate and trusting relationship with your friends and family, they would tend to be more generous with their money. Moreover, people close to you won’t make you jump through hoops like many financial institutions.

![]()

Pro tip: Ask your family members or friends to contribute only the amount they are willing to lose. You may also have them sign a contract to that effect. This will prevent any soured relationships or lawsuits in the future.

From your inner circle, it’s time to move slightly outside your comfort zone. Let me show you how you can get startup funding from other parties without needing to pay.

Funding payment scheme 2: No repayment necessary

There may be no such thing as a free lunch, but with the right conditions, you can have virtually free funding.

Fund sources that don’t require payment offer you the double benefit of “virtually free” money and the motivation to develop a solid business model. This motivation comes from any of the following:

- Performance standards attached to your funding

- The fear of letting down your funders

Read on to learn how these motivations are part of funding vehicles like grants, competition prizes, and donation crowdfunding.

Grants

Grants are gifts of cash given to startup companies, conventional businesses, and nonprofits to help fund their early operational stages.

Small business grants and similar funding can come from government agencies (like the Small Business Administration in the U.S.), nonprofit organizations, charities, or social enterprises.

Though grants won’t typically ask you for payback, they often have strict requirements. As a result, your startup operations could also undergo much scrutiny and supervision from grant funders.

Competition prizes

Winning prize money to raise startup capital can be both personally fulfilling and financially rewarding.

There are many startup pitch competitions in different countries around the world. In these competitions, you could win a cash prize or investment pledge if your business concepts are unique or groundbreaking enough. Some of these events are done online, so it’s okay if you’re not into traveling that much.

![]()

Pro tip: Win or lose, you can use pitch competitions to build networks with other entrepreneurs, connect with potential customers, and market your business idea.

Donation crowdfunding

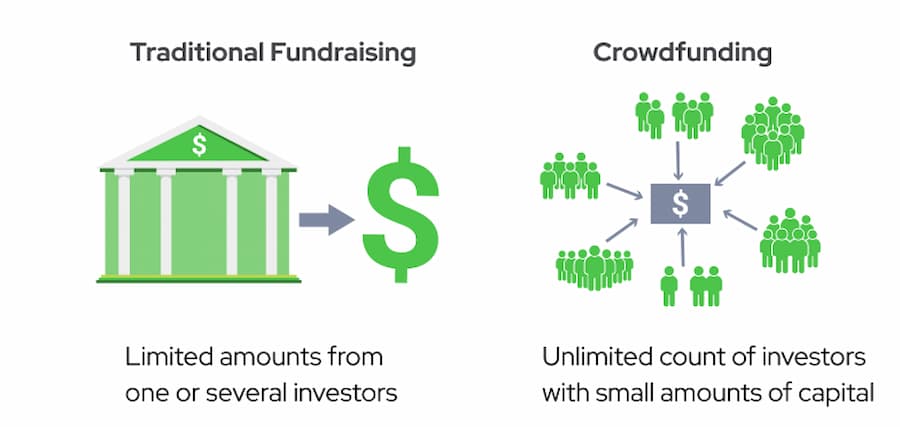

Sources: OpenGeeksLab.com and the European Commission

Another excellent option to fund your startup is through donation-based crowdfunding.

Raising financing this way involves asking a group of supporters to contribute to a cause or business. These supporters don’t get anything in return for their cash, which they usually donate through online platforms.

Donation-based crowdfunding may sound as easy as pie. Though you don’t have to pay other parties in case your startup fails, you may not be able to raise funding the same way again if you don’t succeed. Business failures usually lead to ruined reputations.

![]()

Pro tip: Show your sample product or service to your supporters to successfully raise funds through crowdfunding. Social media innovator Vello and impact-focused startup Good Empire raised millions of dollars from crowdfunding after presenting our design prototypes to their supporters.

Now that you know some virtually-free sources of funding, let’s proceed to financing options that offer flexible payback schemes.

Funding payment scheme 3: Option to pay through non-cash means

Some startup funders provide an option to pay in cash or in kind.

You can generally get more funds from these flexible options compared to personal savings and family sources.

If your startup is short on cash, it can greatly benefit from financing methods like the following:

- Non-donation crowdfunding

- Private equity investments

Non-donation crowdfunding

Some businesses or organizations that raise money through crowdfunding promise their supporters one of the following in return for the funds provided:

- Monetary payment for the total amount raised plus interest (debt crowdfunding)

- Stock ownership (equity crowdfunding)

- Non-cash rewards like free products or services (reward crowdfunding)

Like donation crowdfunding, non-donation crowdfunding is mostly accessible through online platforms or sites.

![]()

Pro tip: To ensure legal protection, make sure the platform you are raising money in is monitored by the government. In the U.S., the Securities and Exchange Commission regulates crowdfunding.

Private equity investments

Private equity (PE) firms tend to invest in startups with good product or service concepts. Unlike ordinary investors, those in PE concentrate on businesses that are not publicly traded on stock exchanges.

Many PE companies get any of the following in exchange for the funding they provide:

- Stocks that give the PE firms part ownership of the startups they invest in

- Control of certain aspects of startup operations

PE investments fall into two broad categories. They are:

- Venture capital

- Angel investment

Let’s delve into each more deeply.

Venture capital

Venture capitalists (VCs) tend to invest in late-stage companies. If your startup has earned a lot of money for quite a few years, it will be easier to approach venture capital firms for funding.

Aside from capital, some VCs provide industry expertise that could kickstart your startup’s growth. In fact, some of our clients secured VC mentorships partly due to our product success teams.

However, take note that some VCs do the following:

- Buy stocks from your startup, only to sell them eventually through an exit strategy

- Seek substantial control of your startup’s management

![]()

Pro tip: When looking for venture capitalists, make sure they have a track record of funding booming startups and an exit strategy that won’t leave you at a disadvantage.

Angel investment

Angel investment and venture capital both place their bets on groundbreaking startup companies. However, unlike many venture capitalists, angel investors tend to:

- Consider investing in startups that have either a solid business plan or are in the early stages of growth

- Prefer a share of startup income instead of management control

Now that you’ve learned some unorthodox funding opportunities, let’s talk a bit about conventional means of startup funding. After all, these normal financing options also have their good points.

Funding option 4: Cash payment required

Funding options that require monetary payment ensure you maintain power over your startup. Institutions in this financing category rarely or never seek operational control over startups.

However, some of these funding vehicles are a bit risky. For example, you may have to give up some of your assets as collateral.

Loans and credit financing are two main types of startup funding where monetary payment is necessary.

Loans

Loans can provide much-needed cash for your startup. However, you are required to pay the total loan amount plus interest.

Loans and credit financing typically require prompt cash repayment with interest, posing a risk of asset forfeiture if unpaid. However, understanding programs like the SBA can mitigate these risks by offering flexible funding options. For more detailed advice, you can read more about SBA loan interest insights.

In general, loans provide more funding than credit financing.

Many banks and online lending platforms offer traditional loans for businesses. However, entrepreneurs and companies could lose their assets as collateral if they were unable to pay certain types of loans.

Credit financing

Like loans, credit financing also charges interest on the amount owed. However, credit financing provides quicker access to funds. This is because, unlike many traditional loans, you don’t need to sign a form for every credit transaction.

Credit financing falls under two broad categories: credit cards and business lines of credit. They differ mainly in the following characteristics:

- Business lines of credit tend to lend more money than credit cards

- Many credit cards have “zero-interest days,” something not often found in business lines of credit

![]()

Pro tip: Microlenders and government agencies tend to provide a cheaper alternative to a traditional business loan. For example, the U.S. government’s Small Business Administration shells out small business loans with lower-than-average interest rates.

![]()

Pro tip: Credit cards for small businesses and startups offer more perks and tend to be less expensive than ordinary credit cards.

Open payment options, open opportunities

Years ago, lack of funds was a big barrier to establishing a startup. Now, varied funding packages have made it easier for startup visionaries to benefit enormously from their ideas.

Funding is just one element of a startup’s success. Coming up with a startup business model that generates income, adds value, and overall works are the other crucial parts.

Adding and growing value through apps is one business model you could consider. In fact, many unique concepts became the next big business through mobile apps and web apps.

We have a track record of growing businesses through a combination of app design and development and end-to-end product strategy. Feel free to chat with us so we can collaborate in turning your bright idea into an awesome startup.

People Also Ask

1. What is the best way to fund a startup without investors?

The best way depends on your appetite for risk. Bootstrapping means betting your own money, but it also means keeping every ounce of control. Many of today’s big exits started exactly this way. Sometimes the investor you really need is just your future self with a thicker wallet.

2. Is crowdfunding a reliable way to raise money for startups?

Crowdfunding isn’t a guarantee, but it’s one of the clearest ways to test if your idea connects with real people. It’s more like a market stress test—if strangers fund your idea, you’ve found validation. If they don’t, you’ve still bought valuable insight for the price of your campaign. Either way, you’re learning whether your idea has legs before you sprint.

3. Are startup grants really worth applying for?

Yes, especially if you’re thinking long-term. Grants are one of the rare funding options that give you money without strings of repayment or equity loss. The reality is that they can feel slow and bureaucratic, but that’s a small price to pay for capital that strengthens your foundation without weakening your stake.

4. Should I borrow money to fund my startup?

Borrowing can buy you time, which is the scarcest resource for a startup. With capital in hand, you can move faster, hire smarter, and catch opportunities before they slip away. The risk is simple: if growth lags, you’re left paying for time you didn’t fully use.

5. What’s the difference between angel investors and venture capitalists?

Angel investors are usually wealthy individuals who invest early, often guided by instinct. VCs are firms that arrive later with bigger checks and bigger expectations. Angels might bet on you; VCs tend to bet on your traction. Both want returns, but their patience levels and terms aren’t equal.

6. Is it smart to raise money from friends and family?

It can be. Friends and family are often the most forgiving investors, but losing their money hurts twice: financially and personally. Mixing holiday dinners with shareholder meetings isn’t for everyone. If you do go this route, treat it like any other investment and put everything in writing.

7. What are the risks of equity crowdfunding?

Equity crowdfunding turns customers into co-owners. The upside is fast funding and a community that’s literally invested in your success. The trade-off is complexity: You’ll be accountable to dozens, even hundreds of shareholders. Managing too many small investors can make negotiations, exits, or even decision-making messy when your startup scales.

8. Which startup funding option is the easiest to get?

Easiest doesn’t always mean best. Credit cards and online loans are quick but expensive. Grants and competitions take time but don’t cost equity. Friends and family might write the fastest check, but that comes with invisible strings. The real question isn’t which is easiest, but which is easiest for you to live with later.

Jesus Carmelo Arguelles, aka Mel, is a Content Marketing Specialist by profession. Though he holds a bachelor’s degree in business administration, he also took courses in fields like computer troubleshooting and data analytics. He also has a wealth of experience in content writing, marketing, education, and customer support.