App Funding: 8 Powerful Strategies to Secure Funding for App Development

There are two types of early-stage startups: Those running out of money and those that will run out of money soon.

And even if you’re currently funded, you will probably fall into the latter category sooner or later.

It’s a massive challenge, especially in the early mobile app idea stage, where you don’t yet have a working app to show to potential investors.

You’re also competing against other established mobile apps for funding.

How do you get the funding to get your great app idea off the ground?

I’ve created this guide based on my learnings and experiences as a startup founder and running an app development agency that’s turned many apps into multimillion-dollar successes. I’ll be delving into the following:

- The stages of app funding

- 8 powerful strategies to get app funding

- Which app funding direction is right for you

- Tips on how to boost your startup success (whether you’re self-funding or raising capital)

- The 5 types of apps that will likely get funding

Read on discover the game-changing strategies to secure funding for your app and propel your success.

Stages of App Funding

#1 Pre-seed funding

Pre-seed funding typically occurs when an idea is still in its infancy, and the founders need capital to explore and validate the concept. The purpose of pre-seed funding is to support activities like market research, concept development, prototyping, and forming the initial team.

#2 Seed funding

Seed funding is focused on transforming the app idea into a viable product or business. It helps cover initial development costs, hiring key talent, and launching the product or service. Startups at this stage typically have a minimum viable product (MVP) or an early version of their app that they can demonstrate to potential investors.

#3 Series funding

Series funding means the various rounds of funding that a startup goes through as it grows and reaches specific goals. The typical series rounds are called Series A, Series B, and so on, but they can go all the way to Series C, D, E, and more.

#4 Late-stage funding

Subsequent funding rounds are usually secured by well-established companies that have already achieved substantial success and market dominance.

The funds are typically used for aggressive expansion, acquiring competitors or complementary businesses, international expansion, and preparing for an IPO or acquisition.

Funding for App Development: 8 Powerful Strategies to Fuel Your Success

Now that you know the different startup funding stages, let’s talk about the various ways to raise financial resources for the development, launch, growth, and maintenance of a mobile application or software:

#1 Bootstrapping: Your cash, your terms

Bootstrapping is when you use your own money, like personal savings and funds, to start and run your business. This is common in the early stages, like before you get other investors involved.

Now you may be wondering, “What if I lose my own money?”

Let’s be brutally honest with each other: there’s a pretty good chance that you might.

But as my former boss and founder of Listcorp put it, “When you invest $100, you may lose $100. But you can also turn it into $1,000 or $10,000. The upside can be almost infinite. ”

It may be worthwhile if you can afford to lose your investment. However, how much you can afford to lose is the defining factor in your decision.

In saying that, bootstrapping is by far the most common mobile app startup funding method.

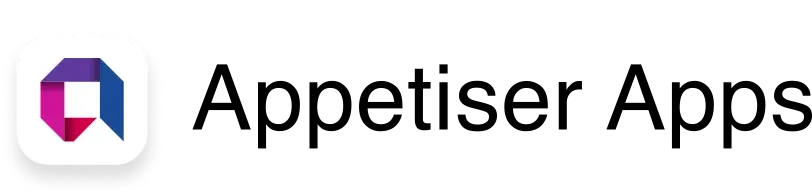

It’s exactly how we helped develop Roamni — an app started by two friends who bootstrapped their way to a valuation of $5 million.

Read Roamni’s case study to learn how.

#2 Friends and family round: Get a boost from those who believe in you most

The “Friends and Family Round” is when you ask for money from your close friends and family to help fund your mobile app development.

When launching an app startup, turning to friends and family for financial assistance can be a viable option. These individuals are typically more willing to invest in your vision and trust your abilities.

Moreover, they may be more flexible and understanding regarding repayment terms and equity arrangements than traditional investors.

However, the risks of asking relatives or friends to invest are substantial. If things go wrong, you may lose your business and sour personal relationships at the same time.

Even if I encourage entrepreneurs to take a leap, I can’t advise for or against raising money from personal relationships.

Here’s the only advice I am comfortable sharing:

If you do raise money from people nearby, treat it like Jeff Bezos did when his parents invested $250,000 into the early stages of Amazon: tell them there’s a 70% chance they will never see the money again.

Even if you’re going above and beyond to make your business work, you want to be certain they can afford to lose the money.

#3 Angel investors: Support from visionary backers

Angel investors invest their funds into early-stage startups in exchange for equity or ownership in the company.

Typically, these investors are seasoned entrepreneurs or high-net-worth individuals with a keen interest in supporting promising startups and generating returns on their investments.

Anyone interested in investing in an early-stage startup can be an angel investor. Imagine reaching out to 100 successful LinkedIn people interested in your industry. There is a high chance that you’ll find people interested in what you do.

In addition to financial support, angel investors’ expertise, industry connections, and mentorship can significantly enhance your chances of app success.

Therefore, it’s crucial to thoroughly research and target angel investors who align with your vision and can contribute beyond just the capital injection.

#4 Venture capitalists: Backing bold ideas for big returns

The most popular startup investors, venture capitalists fund startups and high-growth companies in exchange for equity or ownership stakes.

They typically invest larger amounts of capital compared to angel investors and seek out innovative and high-potential startups with the goal of generating substantial returns on investments.

Interestingly, receiving venture capital funding is the rarest form of startup funding. Generally, this option is explored in later funding rounds (usually when you’re raising millions).

Venture capital firms often require substantially more traction and rarely invest in the first round of funding (the seed round). But even when the chances are slim, I suggest you make some connections early in your startup journey if you have the time to do so!

#5 Crowdfunding: Funding your app with community support

Equity crowdfunding is getting more popular primarily because of platforms like Birchal, Readyfundgo, and Crowdfunding.

These organizations have structures in place to manage many shareholders. The processes are pretty straightforward:

- You set up a profile for your startup and pitch your concept on the sites with a story and images (adding your design prototype for maximum impact).

- Then, you set your app funding targets, and the public can invest money for a small stake in the business (equity). This is a good way of meeting funding goals but requires a great pitch to sell the app business idea.

Many of our clients, such as Good Empire and Wine Valet, recently landed massive equity funding wins. Both pitched their ideas — using our interactive prototypes — to the popular crowdfunding site Birchal.

Check out Good Empire and Wine Valet’s case studies to discover how we can make the same happen for your app.

#6 Debt financing: Borrow smart, grow smart

Borrowing money from a bank is a pretty common route for tech startups to secure funding. It’s fairly straightforward: you borrow the cash and pay it back later on a set schedule. The caveat is loans can be pretty dicey. Investors often want some kind of collateral, like your personal assets, to back up the loan.

Debt financing is usually best suited to entrepreneurs with valuable assets such as real estate properties, expensive vehicles, or existing businesses. But even though we’ve seen bank loans work out for some of our startups, we don’t feel comfortable advising on them due to the extreme risks.

Most successful loans we have seen at Appetiser were used in “sure thing” situations: a situation where you know that spending money will create drastically more value than the money spent.

#7 Accelerator programs: Fast-track your app’s success with expert guidance

An accelerator program is designed to help early-stage startups grow rapidly by providing them with resources, mentorship, education, and sometimes funding.

These programs typically run for a fixed period, often around three to six months, during which startups receive intensive support and guidance to accelerate their development and increase their chances of success.

However, it’s important to weigh the pros and cons. Sometimes, you might end up giving away a significant portion of your equity for information that you could easily find for free online. On the flip side, joining an accelerator can give you access to a powerful network of specialists who can help you go big.

One prominent example of an accelerator program is Y Combinator, based in Silicon Valley, California. It has been instrumental in the growth of numerous successful tech startups, including Airbnb, Dropbox, and Stripe.

#8 Grants: Free money for your bright ideas

Grants in app development are financial awards provided to individuals, startups, or organizations to support the creation, improvement, or advancement of mobile applications.

The good thing about grants is that they are typically non-repayable and are intended to provide funding for app development projects that align with specific objectives or meet certain criteria set by the grant provider.

You also don’t have to give up equity no matter how much funding you acquire.

However, getting approved for grants will be hard before doing any development work. But once you’ve got a very basic app to show, you may be surprised at how much government funding and other grants you are eligible for.

Even reaching out to local and state governments can open many doors for you.

I recommend regularly checking relevant websites, subscribing to newsletters, and staying updated with industry news to ensure you know the latest funding opportunities for app development.

Self-Funding vs. Raising Capital: Which app funding direction is right for you?

Netflix founder Mark Randolph recommends using “other people’s money” (OPM) to finance your startup dream. There’s a lot of wisdom in that, but I only partially agree.

Source: Vanity Fair

The solution to your funding challenge is more nuanced than this.

Let me explain using another example.

It’s 1995, and a slightly geeky 28-year-old tech fanatic has a challenge: how to sell a broken laser printer for $1.

But he doesn’t list his printer in the local classifieds. Instead, the young Iranian-American tries something rare for the time: selling online.oPre-Register

What started as a hobby soon became a business and full-time job, with our entrepreneur pouring all his time and energy into making it a success. The founder was Pierre Omidyar, and while you might not know his name, I’m certain you’ve used his platform: eBay.

Source: Britannica

Now, here’s the important thing: eBay was entirely self-funded until its first large venture round in 1997.

That’s right, eBay was entirely self-funded for two years before receiving $ 6.6 million in funding from a venture capital firm. It then went on to become a $25+ billion business.

Netflix and eBay took different approaches to fund their app development, but both found success.

The moral of the stories? It’s on a case-by-case basis.

So, here’s what I can really advise you…

Start with your own ‘why’

Aside from being a startup founder, I’ve also worked with entrepreneurs for over a decade.

Throughout that time, I discovered that there are three main reasons people start their own thrilling journey of entrepreneurship. And these reasons will ultimately guide you to your answer.

Reason 1: I want to make a change!

As a visionary, you are likely to inspire the people around you. Even if you don’t love being on stage trying to change the world, there will still be a spark in your eyes when you speak about the problem you are trying to solve.

You will inspire others. And this is where you create FOMO (fear of missing out). Everyone wants to be part of your team, your success, and your venture.

But early investors will take a considerable chunk of the equity of your business. And often they’re not the people that are valuable shareholders in the long run.

Common investment advice preaches you should own a small piece of a large pie rather than a big piece of a small pie. This means you should grow your company as large as possible, despite how much equity you give up.

Simply put, 10% of a $ 100 million company is worth more than 50% of a $12 million company. While financially, this is true, you run the risk that you fail your mission.

Remember, you started this company to improve the world — ultimately, you’re likely the best person to make this happen.

However, be aware that selling too much too early can impact your ability to make your change because you lack decision-making power.

As a result, you may find yourself owning a small piece of the pie when you could have owned the entire pie factory.

Reason 2: I want to make a lot of money!

Right now, there are two possible scenarios: you raise development money or fund your app yourself.

Let’s use an oversimplified formula:

Scenario A: You raise $100,000 for development, in exchange for 50% equity.

Your share = 50% (equity) $1,000,000 (future company value) 60% (chance of success) – $0 (your investment) = $300,000

Scenario B: Invest $100,000 into development (and retain 100% equity)

Your share = 100% (equity) $1,000,000 (future company value) 60% (chance of success) – $100,000 (your investment) = $540,000

Based on your predictions, you’re expected to own a share of over $500,000 if you self-fund. That’s $240,000 higher than if you raise money too early!

And while you are likely overly confident in your success chances, there’s also one more future upside: if your startup continues to grow, your larger equity stake will be worth so much more in scenario B!

Now, why am I teaching such primitive equations? To help you avoid making an emotional decision. Try to look at both the upside and the downside before you make a solid decision.

Reason 3: I want to be my own boss!

Here’s a little secret: if you raise a lot of money early, you’ll likely soon be working for your investor.

If someone funds the development of your app, they’ll probably own at least 40% of your business. Kudos to you if you manage to keep much more than 60%!

The chances that you still own more than 50% after your second or third funding round are slim. And your investors will protect their investment.

There’s a reason that Reed Hastings owned 70% of Netflix upon launch. While he worked as a chairman (and not full-time early on), he put up his own money upfront!

So, if being your own boss is why you’ve started this journey, consider self-funding or, if you go the capital-raising route, protect your interests.

How to Boost Your Startup Success (Whether You’re Self-Funding or Raising Capital)

#1 Raise in stages

Imagine your startup requires roughly $1,000,000 to get off the ground.

But after designing your prototype, you decide to fund the initial MVP app development yourself. So you put in the $100,000 needed to get started. And while you’re developing, your startup’s value increases weekly.

During development, you put the time into raising $300,000 more. You give up 15% of the equity in your startup for the money you’re raising. This money is invested in further development, product marketing, and growth.

You decide to raise another $600,000 a few months later when you have traction. This time, you and your initial investor are giving up 20% of the total equity of your startup.

What’s the result?

After the first equity split, you’re an 85% shareholder; after the second, you’re a 68% shareholder in your own business. Now, how does that feel?

In the first scenario, you’re working for someone else who owns 75% of your business. In the second, you’re your business’s largest shareholder and driver. As a result, you’re the primary decision-maker. You can drive the change you want to see in this world.

Many of our Appetiser success stories have done precisely that! So, consider taking things one step at a time. And if you need guidance in doing that, hit us up, and we’ll be glad to help.

#2 Craft a compelling business plan and pitch

A compelling business plan and pitch are crucial when seeking app development funding. It helps you present your app ideas, demonstrate the viability of your project, and convince potential investors or grant providers to support your venture.

Key elements of a compelling business plan and pitch

- Executive summary. Start with a concise and engaging executive summary that provides an overview of your app, its unique value proposition, target market, and the funding you are seeking. Make sure to highlight the problem you are solving and the market opportunity.

- Problem statement. Clearly define the problem or pain point your app addresses. Explain why existing solutions are inadequate and showcase the market demand for your app. Provide data, market research, and user insights to support your claims.

- Solution and value proposition. Present your app as the solution to the identified problem. Explain how your app is different, innovative, and superior to existing alternatives. Emphasize the unique features, benefits, and value it offers to users. Include visuals, wireframes, or mockups to give a glimpse of your app’s interface and user experience.

- Market analysis. Conduct thorough research on your target market, including its size, growth potential, and trends. Identify your target audience and outline your customer personas. Discuss your go-to-market strategy and how you plan to acquire and retain users. Include any competitive analysis that showcases your competitive advantages.

- Monetization strategy. Explain how you plan to generate revenue from your app, whether through advertising, in-app purchases, subscriptions, or other means. Provide financial projections and demonstrate the potential for profitability.

- Marketing and growth plan. Outline your marketing and user acquisition strategies. Explain how you will reach your target audience, create brand awareness, and drive user adoption. Discuss your user retention and growth plans, including engagement strategies and product improvement cycles.

- Team and expertise. Highlight the qualifications and expertise of your team members, emphasizing their relevant experience in app development, technology, marketing, or business. If any advisors or industry experts support your venture, mention their contributions.

- Financials. Include financial projections, such as revenue forecasts, expense breakdowns, and key metrics. Provide a clear picture of your funding requirements and how the requested funds will be utilized. Showcase your understanding of financial aspects and your app’s potential return on investment.

- Pitch deck. Create a visually appealing and concise pitch deck to accompany your business plan. Summarize the key points of your project in a visually compelling format. Use graphics, charts, and images to support your message. Keep the slides focused and engaging.

💡 Remember to tailor your business plan and pitch to the specific requirements and interests of the investors or grant providers you are targeting. Lastly, continually refine your business plan and pitch based on feedback and new insights.

#3 Create FOMO!

Imagine yourself in this scenario:

Your MVP app development costs $100,000, but you only have $50,000 in the bank. So you need to raise $50,000 to develop your app. But if you reach out to people right now, you’ll look needy.

Any seasoned investor will squeeze you for equity and take more than he should.

But an excellent way to shift into the power position is to Create Fear of Missing Out (FOMO).

In this strategy, leveraging your minimum viable product is crucial. The existence of an MVP demonstrates to potential investors that you have made progress in the app development process and have tangible evidence of market validation.

Show evidence of traction, user engagement, and market validation to instill confidence in investors. This can include user feedback, early user acquisition data, partnerships, press coverage, or revenue-generating activities.

Proving the demand and potential of your MVP app strengthens your case for funding.

Instead of saying, “I need your money to launch my mobile app,” you’re sending this powerful message to attract investors:

“I’m doing this with or without you. My startup is gaining a lot of interest, and I’m choosing the right investors.”

You’ll show people you’re serious about what you’re doing and willing to bet on yourself. People who were previously on the fence may suddenly make the leap.

We’ve seen this strategy drastically increase the amount of money that some of our startups have raised while also increasing the valuation.

Yes, that’s right, more people jumped on and offered to pay more for less equity. And the investors were happy about investing in a founder who is driven.

Win-win!

5 types of apps are more likely to attract funding

Now that you’re aware of the different funding options and how to pursue them effectively, let’s focus on increasing your chances of success by exploring which specific apps are more likely to secure funding.

1. Health and wellness apps

With an increasing focus on personal well-being, health and wellness apps have become a hot commodity in the app market. The global fitness app market size is projected to reach $5.41 billion by 2030. Meanwhile, the revenue from health apps is estimated to reach $35.7 billion by the same year.

These apps offer a range of features, including fitness tracking, meal planning, and sleep tracking. As consumers prioritize their health more than ever before, investors are eager to support apps that empower users to lead healthier lifestyles and make informed choices about their well-being.

If you have a passion for health and wellness and an idea for an app that can address current health concerns, this could be a lucrative market to explore.

2. Sustainability tracker and eco-friendly guide

Environmental sustainability is a growing concern worldwide, and apps that promote eco-friendly practices and sustainable living are gaining traction among investors. Case in point: Good Empire.

Check out our portfolio to learn how Good Empire has inspired over a thousand investors and raised over $1 million without any development needed.

In the United States, 66% of consumers are ready to spend extra on sustainable products, and 80% of young adults (aged 18-34) share this willingness. Globally, 82% of consumers are willing to pay more for products in sustainable packaging, up from previous years, with younger consumers leading at 90%.

These apps offer tools for carbon footprint tracking, sustainable product discovery, recycling guides, and tips for reducing waste. If you have a vision for an app that can contribute to a greener future and promote sustainable living, this is a market worth exploring.

3. Financial management apps

These apps offer features such as budgeting tools, expense tracking, investment management, financial education, and personalized financial advice. With consumers looking for tools to help them achieve their financial goals and improve their financial well-being, there is a growing demand for apps that empower users to take control of their finances.

The personal finance app market has seen significant growth over the last four years, with mobile budget applications exceeding 573 million downloads in 2021. This figure reflects a promising niche for developers and a highly competitive environment.

If you have a background in finance or a passion for helping others manage their money, developing a financial management app could be a lucrative venture.

4. Education and learning apps

The rise of online learning has led to increased demand for education and learning apps that provide access to educational content, skill development courses, language learning programs, and tutoring services.

According to Fact.MR, the global e-Learning apps market size is currently valued at $ 239.2 billion and is projected to surpass US$ 476.5 billion by 2032. The growth is attributed not only to the increase in popularity of online education but also to the growing demand from professionals who want to reskill or upskill. Some of these professionals want to remain relevant in a workplace increasingly influenced by artificial intelligence.

Investors are keen to support apps that offer innovative solutions for online learning and address the changing needs of learners. If you have a passion for education and a vision for an app that can revolutionize the way people learn, this market offers ample opportunities for growth and success.

5. Mental health and well-being hub

The importance of mental health and emotional well-being has gained significant recognition in recent years, leading to a surge in demand for apps that provide mental health support and resources. The global mental health apps market is projected to witness substantial growth, reaching an estimated value of approximately $23.8 billion by 2032.

Mental wellness apps offer a range of features, including mindfulness exercises, therapy sessions, mood tracking, stress management tools, and community support groups.

Investors are increasingly interested in supporting apps that offer effective solutions for managing stress, anxiety, depression, and other mental health challenges. If you have a passion for mental health advocacy and a vision for an app that can make a positive impact on users’ emotional well-being, this market presents promising opportunities for funding and growth.

Bet on yourself and the right people will bet on you

Developing an app isn’t cheap; taking a great app idea and turning it into a successful business requires plenty of investment.

The most important thing is that you think through each funding stage and what it will mean for your app idea, business model, and long-term goals.

I’ve personally founded a handful of startups myself; some of them were successful, others not so much. One of my biggest downfalls was my team choice.

While most of my cofounders are wonderful people, I got into business with people I liked rather than people who wanted to grow our ideas as aggressively as I did. We had a different appetite for risk and often spent hours debating the future rather than proving ourselves in the market.

If I started another venture tomorrow, I’d take it as far as I possibly could myself and only part with equity if I gain strategic partners.

Finally, determination and passion also increase the value of your ventures. Most investors will ultimately invest in you, the entrepreneur.

And so consider this: leading by example, putting in your own time and money early on means you keep a majority stake. So ultimately, you’re betting on yourself.

And if you don’t bet on yourself, who will?

Got an app idea? Appetiser is that partner that will invest and bet on you. Let’s chat about creating something great today.