How to Create a Fintech App in 6 Simple Steps

With fintech, you can build a business out of thin air.

The magic of fintech (financial technology) has made money “invisible” yet portable. Once money becomes digital, people can pay bills, buy stuff, or grow their investments without leaving home or holding physical cash.

This “ethereal” e-money ecosystem has contributed to the massive value of the global fintech market, which amounted to around $80 billion in 2023.

If you know what to do and who to work with, you can develop your own fintech app to take advantage of this market and build a sustainable business around it.

Read this article to discover fresh and actionable insights on (click on any bullet point below to go straight to that section of the article):

- The current landscape of the fintech industry

- Major types of fintech apps

- The fastest, simplest, and most effective strategy to create a fintech app for mobile devices

- The legal implications of fintech app development

- Highly innovative fintech apps you can get inspiration from

Time to dig in!

The fintech industry landscape

Before you win in a competitive arena, you must first know what you’re up against.

There are 13,100 fintech companies in the Americas alone, while the rest of the world has thousands of these firms.

But don’t let these numbers scare you. There’s always a way to break through even the toughest markets.

Before he became a retail tycoon, Sam Walton started small. But he laid his foundations correctly. He succeeded mainly by studying his competitors well and finding his niche. You can also apply this strategy amidst the intense competition in fintech apps. We will discuss this strategy later in the article. But for now, let’s have a look at what major types of fintech apps are out there.

Major fintech app categories

Payment processing apps

Payment processing apps act as intermediaries in managing transactions for companies and entrepreneurs. These apps link payment service providers with customer data to facilitate online and mobile payments.

When integrated seamlessly into the e-commerce ecosystem, payment processing apps elevate customer convenience. They empower customers to purchase products and services through debit and credit card transactions and various online payment options.

Insurance technology (InsurTech) apps

Despite being a relatively new domain, InsurTech is rapidly evolving. Its market size is estimated at $5.45 billion in 2022.

InsurTech apps offer users quicker avenues to apply for insurance coverage and handle claims efficiently.

These applications cater to diverse insurance needs such as property, automotive, pet, and life. InsurTech apps not only streamline claims management for clients but also help insurance agents conduct onsite risk evaluations and negotiate better options. To support lending features, they often rely on robust loan servicing systems that handle repayments, interest tracking, and compliance.

Digital banking apps

Digital banking and lending applications empower users to oversee their bank accounts and access various financial services without the need to visit a brick-and-mortar branch.

These applications offer a comprehensive suite of services similar to the ones available in traditional banks, such as account opening, balance monitoring, fund transfers, mobile payments, loan acquisition, and more. The main advantage is that they’re transparent and easy to use, providing users with round-the-clock access to banking services.

Investment apps

Investment apps are leading the charge in democratizing investing. They open up access to financial markets for individuals across all income brackets. By cutting out middlemen, reducing fees, and simplifying trading processes, these apps empower more users to trade and invest with ease.

Taking investment apps to the next level, robo-advisors use extensive automation to help users grow their money more efficiently and at scale. These investment platforms use advanced programming to provide investment and financial planning advice and services with little to no human supervision. Robo-advisors can offer automated brokerage services, handle portfolio management, and execute trades on behalf of users. Through artificial intelligence and machine learning, they analyze users’ financial profiles and risk tolerance to make informed investment decisions.

Personal finance apps

Personal finance apps help individuals take control of their money and find insights to make better financial decisions.

Within these platforms, user interaction remains seamlessly intuitive: users can set financial goals, come up with budgets, track expenses, and connect their bank cards or accounts.

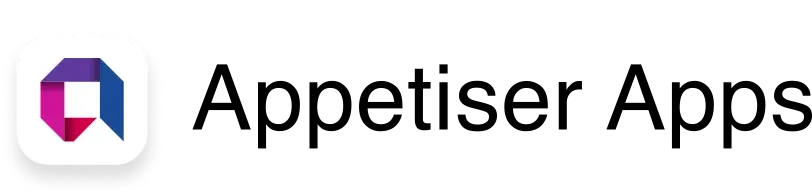

There are many ways to manage one’s finances, and one method is to ensure you get the optimum value for every dollar spent on real estate. This is where the Praisal app excels. Though not a personal finance app, it helps with managing financial resources by enabling homebuyers to negotiate for lower prices even before real properties hit the market. Check out the Praisal case study to learn more.

Tax management apps

Tackling taxes can prove to be one of the trickiest aspects of managing finances. The complexity of tax regulations often leads to confusion and potential errors. Varied income tax rates for individuals and businesses, tax incentives, and frequent legislative changes only add to the difficulty.

Fintech firms develop applications aimed at streamlining the preparation, submission, and monitoring of tax-related documents. With automation at the core, there’s no longer a necessity to engage an accountant or possess prior experience to navigate through the process.

Exchanges and exchange services

These platforms operate on the web and facilitate currency exchange over the internet. Many banks and financial institutions deal with digital currencies, so they need platforms where customers can transfer money or buy the currencies they want.

With the arrival of blockchain technology, cryptocurrency exchanges have become possible. People use these platforms to buy, sell, or trade different cryptocurrencies, which are basically a special form of digital money. Cryptocurrency exchanges act like online brokerage companies but with an innovative twist. They allow users to put physical cash in and get digital money out. Some exchanges also let users earn interest on the cryptocurrencies they hold in their accounts. By incorporating crypto options trading, these platforms further expand the ways users can benefit from their crypto holdings.

To help users make informed decisions about their cryptocurrency investments, many exchanges offer crypto calculator. These tools can help users estimate potential profits or losses, calculate transaction fees, and determine the best time to buy or sell.

But the fintech industry still has room for those into more conventional exchanges. Many users leverage stock apps to manage their investments.

The Simple 6-Step Process to Create a Successful Fintech App

Step 1: Research about your market and competitors

Source: AZ QUOTES

I mentioned earlier how Sam Walton grew his business by drilling deep into customer needs and competitor characteristics. Through this strategy, he transformed Walmart from a small rural grocery store into one of America’s leading brands.

When we helped companies and entrepreneurs succeed through growth-enhancing digital solutions, we advised them to do as Walton did. This is the same advice we will give to you if you seek to succeed in the competitive world of fintech app development.

Carefully study the potential market closest to you physically and build a fintech app for that group of users. What are their demographics, preferences, and needs? What problems are they experiencing when managing their finances?

Though it’s not bad to try and conquer the global app market, save that for later when your app has started gaining traction among users. Just make sure that in the development stage, your app has the right architecture to scale and expand when the demand calls for it.

Taking baby steps is the key to studying your target market. The table below shows some segments of the local market from which you could gather data and what questions you could ask them.

| Segment of the Local Market | Questions for Developing Your Fintech App Idea |

|---|---|

| Local residents, family, and friends, local sports leagues, etc. | What inconveniences are you experiencing when paying using digital platforms? |

| Small businesses | Are you having trouble receiving payments from customers? Is it difficult to wire funds to your suppliers and other business partners? |

| Local churches and charities | Do you think a fintech app could help you raise funds more quickly? What features would you want from such an app? |

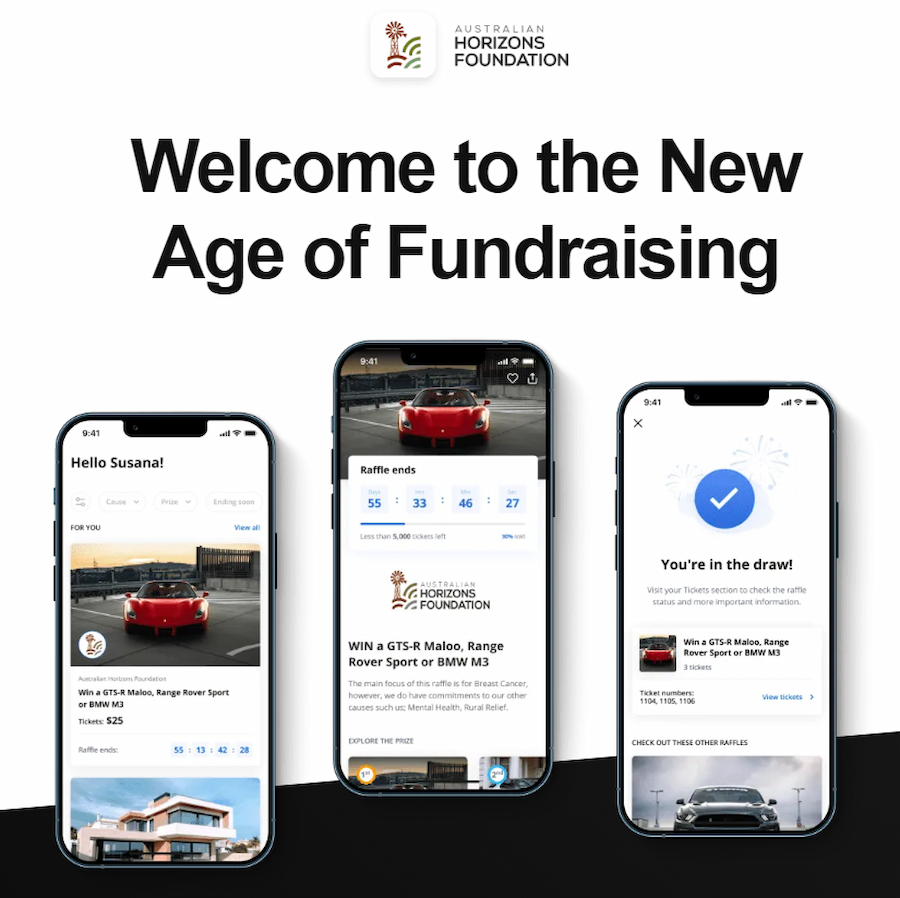

Digital technology has been successfully used to raise funds for charities. Case in point, the success story of AHF/One Raise. In a nutshell, a philanthropist named Matt Gollan and the One Raise team mobilized around $600,000 within the first 24 hours of their web app going live.

Given that charities aim for maximum inclusivity, you can use this core value as one of your guiding principles to make your fintech app unique. Try to make your app as inclusive as possible while localizing the user experience to ensure it stands out among the sea of fintech applications available.

After you’ve identified the pain points of the people and organizations closest to you, it’s time to explore rival fintech apps for insights.

Look at competitor apps to find inspiration

There are too many fintech mobile apps out there, so I carefully selected the most innovative ones. Of course, these apps are here so you can get some ideas. Remember that if you ever adopt some features of these applications, make sure they match the needs of your target market.

MoneyLion

Launched in 2013, this fintech app caters to areas with few to no banks and those living paycheck to paycheck. It offers various financial tools, such as early paycheck access, paycheck advances up to $500 with no fees, personal loans, investment accounts, and credit-building tools.

The app stands out for its focus on financial wellness, freemium model, and transparency on fees. Overall, MoneyLion serves its target demographic well through an extensive suite of tailored features for financial management and credit improvement.

Stash

Stash allows users to invest in fractional shares of stocks and ETFs without commission fees.

Its Smart Portfolio feature provides a robo-advisor service that automatically sets up stock portfolios tailored to users’ appetite for investment risks. For example, the app will provide a conservative user with stocks from companies that earn relatively little but have the least risk of failing. For those with an appetite for high risks, Stash will recommend stocks from businesses that earn a massive return but operate in a market where business closure is more likely.

Other unique features include the ability to invest even small amounts of money to purchase stocks (when buying stocks normally requires a huge cash outlay), a Stock-Back® Card rewarding users with stock for everyday purchases, and a strong focus on educational resources to empower users with investment knowledge and decision-making skills.

Step 2: Size up the legal landscape

A fintech app handles sensitive data.

As such, it’s important to watch out for legalities in this aspect of your app’s operations. For example, America’s Gramm-Leach-Bliley Act (GLBA) and Europe’s General Data Protection Regulation (GDPR) mandate how financial data must be secured and utilized. Ensure compliance with related legislation in your app’s target jurisdiction and applicable international laws to avoid any legal implications.

And depending on the app’s functionality, developers may need specific licenses, especially for payments or securities trading.

By thoroughly assessing the legal landscape, fintech developers can ensure smooth operations, mitigate risks, and build secure and trustworthy applications. This approach not only fosters compliance but also enhances user trust, a critical factor for success in the competitive fintech industry.

Once you’ve gathered enough information about your target market, competitors, and related laws, it’s time to outline the features of your MVP app.

Step 3: Outline your fintech app’s MVP features

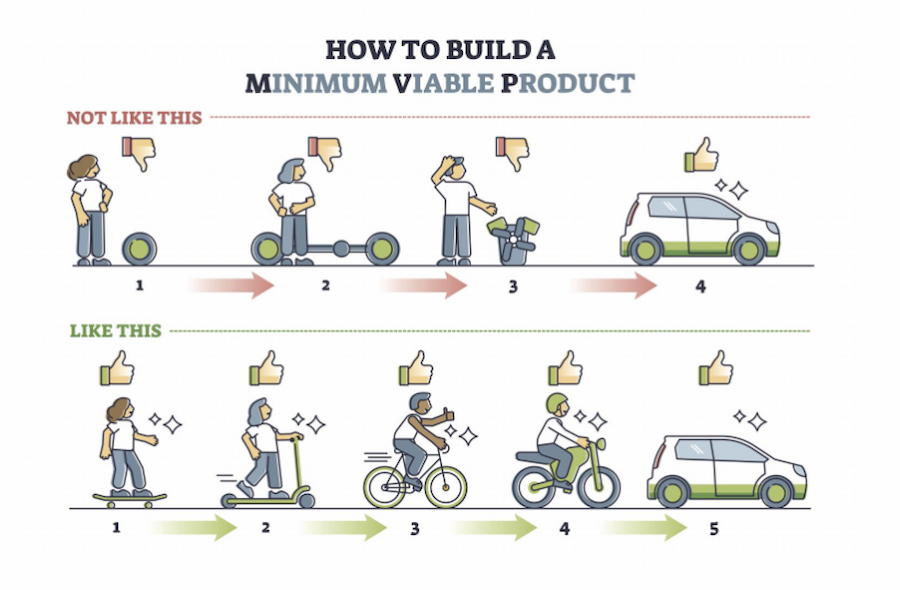

Source: Inflective

The MVP (Minimum Viable Product) is the basic version of your fintech app.

In outlining your MVP, include only the basic features while reserving advanced functionalities for later when your fintech app has already gained traction in the market.

Take note that adopting the MVP approach isn’t about cutting corners or delivering a subpar version of your app. Remember, even the basic version of your fintech app is a final product, albeit designed for easy adaptation based on market feedback.

I recommend reading our article on MVP examples and strategies to learn more.

Basic features of a fintech app

Here are some features essential for a fintech application:

- Accommodations for basic financial transactions. Users should be empowered to conduct payments and efficiently manage their finances. Additionally, facilitating easy fund distribution among various cards, accounts, and popular virtual wallets enhances user convenience.

- Card linkage. This involves seamlessly integrating the payment gateway and enabling users to link and manage their bank cards.

- Custom notifications. Providing timely push notifications for fund debits or credits, as well as updates from banks and tech support regarding their news and offers, keeps users informed and engaged.

- Security features. Functionalities to protect users’ data are vital in any financial application. These include robust measures such as password or PIN protection, transaction verifications using one-time SMS codes, and two-factor authentication. Incorporating a comprehensive security protocol, advanced data encryption, and a straightforward yet secure login process is also crucial.

Advanced features of a fintech app

Once your fintech app gained ample traction and has attracted enough loyal following to grow sustainably, you can consider adding features that can further enhance the experience of your app users. Here are some of the popular advanced features of fintech apps:

- Personalization and AI algorithms. These include features like streamlined money transfers to frequently used contacts, prioritizing regularly accessed services on the main interface, real-time spending analytics, and more. Incorporating mobile app analytics tools can augment AI when predicting customer behavior and tailoring offers accordingly.

- Autopay options. Instead of users worrying about remembering and paying utilities and loan repayments, automation can do the heavy lifting for them.

- QR-code payments. These allow users to conveniently use their mobile banking app to scan QR codes or utilize a button within the interface for seamless transactions.

- Additional services beyond traditional finance. Integrating features like food ordering, ticket purchases, or charitable donations can enhance user experience.

Now you know how to outline the features for your MVP, it’s time to start designing your fintech app.

Step 4: Begin app design

Creating a fintech app doesn’t just mean jumping straight into coding. At Appetiser Apps, we recommend starting with a prototype before diving into full-fledged fintech mobile app development. This helps ensure your app will be successful in the long run while providing extra opportunities to raise much-needed funding for the development phase.

Think of a prototype as the architectural blueprint for your fintech application. It isn’t the final product but rather a representation of your app’s layout and visual presentation.

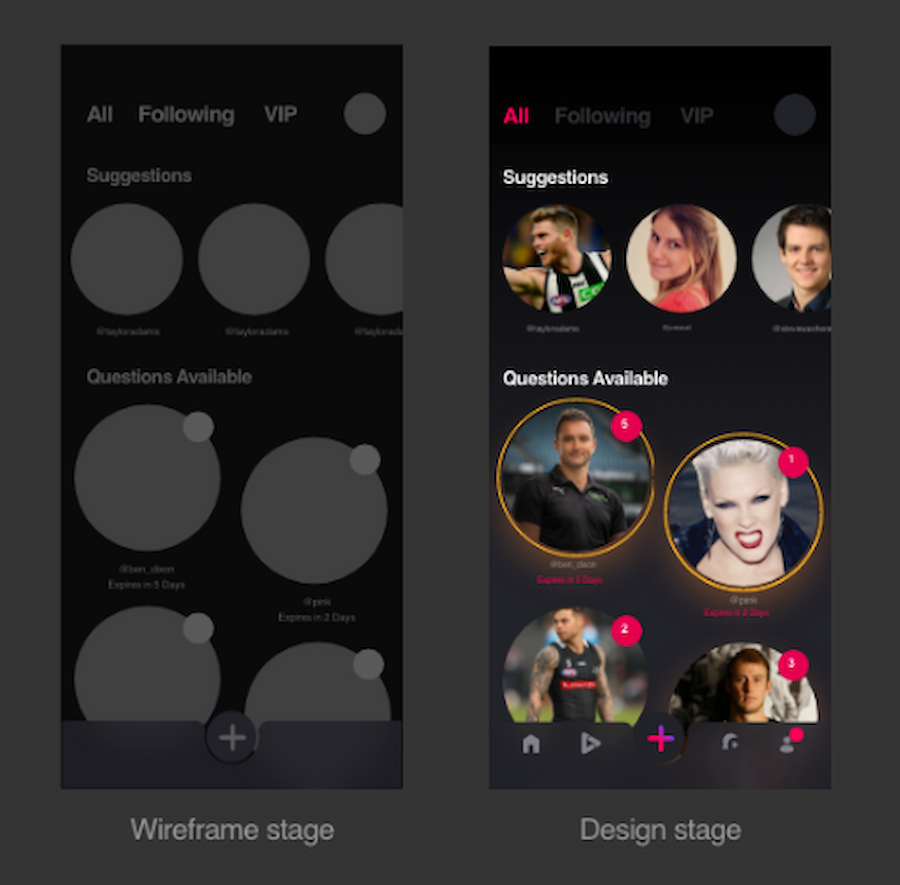

Before our developers begin building apps, our designers generate sketches and wireframes.

Sketching

Our designers use digital tools to draft rough design concepts that encapsulate our clients’ product ideas and key app features. This phase enables us to explore various design concepts, layouts, and user pathways before coding.

In our experience, requirements often shift once development begins. Making necessary adjustments during the sketching phase can streamline the process and mitigate costs. After all, it’s more efficient and economical to modify sketches than to rewrite the code supporting a fintech app.

Sketches also facilitate clear communication between designers and developers, ensuring alignment on the app’s design and functionality. Such clarity ensures our clients receive an app that is consistent with their vision and objectives.

Once a sketch is approved, it serves as the groundwork for project scoping and estimating app development costs.

Wireframing

Wireframing follows the sketching phase. This involves visually outlining user pathways and considering additional screens and sections for the app.

The aim of wireframing is to construct an interactive prototype for assessing functionality, user experience, and overall structure. It aids in pinpointing usability issues and allows for adjustments before full-scale development begins.

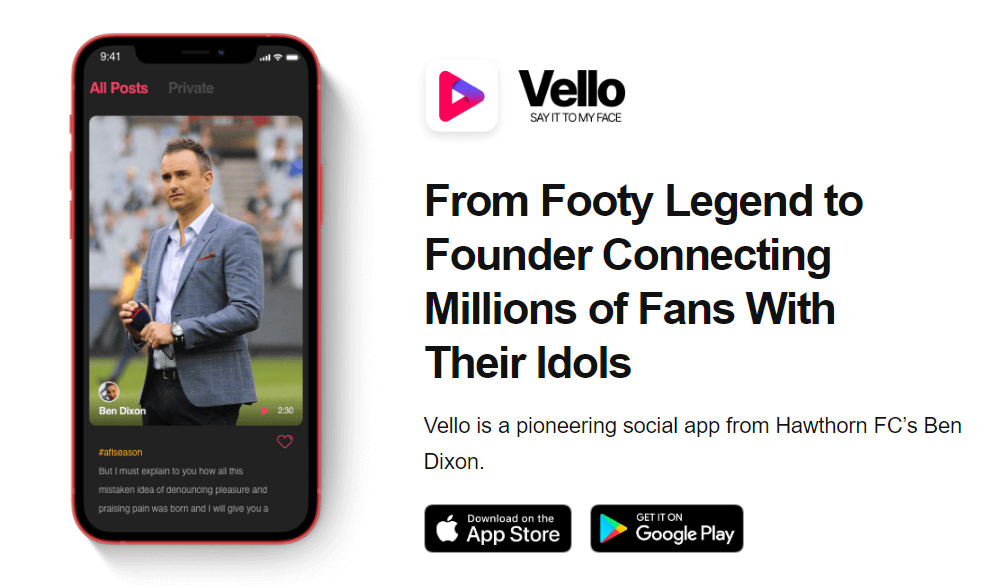

How design attracts investments

A well-crafted prototype can pique investor interest, as evidenced by the case of Vello. Through a prototype we helped design, athlete Ben Dixon secured ample funding to create a distinctive social media app that revolutionizes how celebrities and fans interact. The funding he obtained totaled approximately half a million dollars.

What are the key takeaways from the design phase? Whether you possess coding prowess or not, producing a prototype before development offers a better chance of success for your application while keeping expenses manageable.

When done right, designs provide the right foundation on which you can build your fintech app.

Step 5: Build your fintech app

After you’ve developed a viable prototype, it’s time to transform it into a fully functional fintech app.

Effectively building your application largely entails choosing suitable app development tools and methodologies. Once you understand these aspects, you can proceed with independent development, hire in-house developers, or work with app agencies.

Tools

There are various programming languages suitable for fintech application development.

At Appetiser, our developers create mobile apps for both Android and iOS platforms using Kotlin and Swift programming languages, respectively. We select these languages to ensure our applications remain easily updatable and future-proof. And the native capabilities of these tools ensure your app performs well enough to meet the heavy technical demands typically imposed on fintech app operations.

Methodologies

Different app development methodologies are available, and selecting the most suitable one is crucial for developing the best possible application while managing costs.

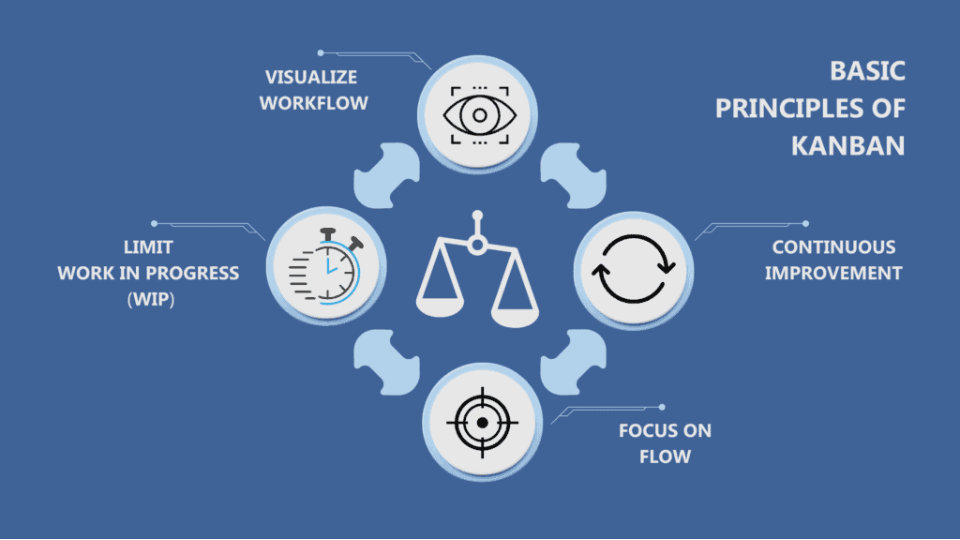

Our developers highly recommend adopting an Agile methodology known as Kanban (for more insights into this approach, refer to our article on software development methodologies).

Kanban revolves around the following principles:

- Visualizing work

- Limiting work in progress

- Continuously improving

Source: Simon Sez IT

We prefer this method because it empowers clients, giving them control over the project and their budget.

Here’s how we implement the Kanban method:

- Initially, we categorize our clients’ MVP feature requirements into Kanban months, creating a product development roadmap.

- Next, we assemble a team to collaborate with our clients in application development. The team’s size depends on the complexity of project features and requirements.

- Following the priorities set in the roadmap, the development team implements the necessary basic features as per the Kanban month schedule.

- We regularly gather feedback from clients on the applications we develop. Our team incorporates any feedback and enhances the apps accordingly.

When you partner with us on your fintech application development project, you have full control over the extent of development you wish to undertake each month. You can seamlessly scale up, downsize, or stop at any point.

If any features exceed the allocated time, they’re rescheduled for the following month, with adjustments to the roadmap as necessary. Upon completing the Kanban months within the MVP scope, your application will be ready for launch.

Ideally, these tools and methodologies result in fintech applications that closely align with users’ expectations. Once development is complete, you’re ready to launch your app into the market.

Step 6: Launch, market, and improve your fintech app

The final stage of fintech app development represents more of an ongoing journey than a definitive destination. This indicates that both marketing efforts and app enhancements should be continuous to maintain a competitive edge.

Even before launching your new fintech app on various app stores, we recommend you engage in pre-launch marketing.

Pre-launch marketing is important in building anticipation, sparking interest, and generating excitement for your app before its official launch. This strategy enables you to reach a broader audience and cultivate enthusiasm, ultimately leading to increased downloads and sign-ups upon your app’s release.

Consider establishing a landing page or website to encourage maximum user sign-ups for your fintech app.

Upon release, effectively convey your app’s unique offering by:

- Implementing app store optimization

- Employing SEO best practices for your landing page

- Utilizing social media for promotion

- Conducting other impactful app marketing strategies

Following the launch, be sure to keep doing the following to ensure the sustained growth and prosperity of your fintech app:

- Monitor vital app metrics like acquired active users and average session duration to identify areas needing improvement.

- Develop an efficient customer service strategy to address complaints and other issues, potentially through customer experience automation.

- Offer timely and pertinent updates to resolve bugs and enhance the overall user experience.

- Explore innovative methods to continue promoting your app without sounding too pushy.

Find financial freedom with a fintech app

More and more payments are being made digitally, despite the persistence of on-site purchases. That’s why investing in a fintech app is one of the best decisions you can make to take advantage of this brave new economic world.

We hope this article provided you with the right information to help you get started with fintech app development. And if you have other questions, feel free to reach out to us so we can help you succeed in the world of fintech and other industries ripe for digitalization.

Jesus Carmelo Arguelles, aka Mel, is a Content Marketing Specialist by profession. Though he holds a bachelor’s degree in business administration, he also took courses in fields like computer troubleshooting and data analytics. He also has a wealth of experience in content writing, marketing, education, and customer support.